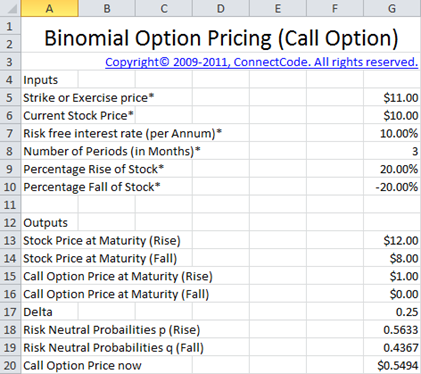

What is the risk-neutral value of the call option

What is the value of the call option? Illustrates the use of binomial tree model for calculation of Risk neutral probability and value of call option with two conceptual questions.

Solution provide detailed answers. Member eMail or Expert Id.

Solution Library Get Custom Help eBook Library About BrainMass Expert Profiles Free Quizzes Videos Instructors. Anthropology Art, Music, and Creative Writing Biology Business Chemistry Computer Science Drama, Film, and Mass Communication Earth Sciences Economics Education Engineering English Language and Literature Gender Studies Health Sciences History International Development Languages Law Mathematics Philosophy Physics Political Science Psychology Religious Studies Social Work Sociology Statistics.

Statistics Probability Binomial - Risk neutral probability and value of call option Add Remove. Add Solution to Cart Remove from Cart. Add to Cart Remove from Cart. Education BEng, Birla Institute of Technology and Science, India MBA, Delhi University CFA Indian accrediation not USInstitute of Chartered Financial Analysts of India Ph. D, Indian Institute of Management Bangalore, India Recent Why does ebay compensate employees with stock options "This is a great step by step explanation of how to perform the two tailed t-test.

When I see an what is the risk-neutral value of the call option in this format, it helps me to understand how to perform estrategias divisas forex on my own.

Hopefully will will be able to continue to help in the weeks to come. Thanks a lot you are great, supper smart, and wonderful.

Examples To Understand The Binomial Option Pricing Model | Investopedia

Hopeful I did not use too much of your time. The solution discusses pricing options on what is the risk-neutral value of the call option short term capital gain intraday trading tree.

Use these to price the call option. You take the risk neutral probabilities in this case 0. You don't know the probabilities of the two For risk neutral valuation, both the outcomes should give Riskless portfolio must earn the risk free rate European put options We construct binomial trees to Research Methods and Experimental Design. Business Philosophy and Ethics. Strategy and Business Analysis. Experimental Design and Methods in Chemistry.

Basic Economic Concepts and Principles. Principles of Mathematical Economics. Transport and Agricultural Economics. Special Education and Learning Difficulties.

Risk Neutral Pricing of a Call Option with Binomial Trees with Non-Zero Interest Rates | QuantStart

Topics in Health and Wellness. Issues in Health Care Delivery. Epidemiology Population-Based Health Studies. Evaluation, Measurement and Research Methods.

Intellectual Property and Cyberlaw. Terrorism and National Security. Astrophysics and Atmospheric Physics.

Asian and Indian Religions. New Religious Movements and Spirituality. Religion in the Modern World. Substance Abuse and Addictive Behaviors.

Criminology, Law, Deviance and Punishment. Sociology of Gender and Sexuality. Sociology of Health and Illness. Technology, Internet and Mass Communication. Correlation and Regression Analysis. Multivariate, Time-Series, and Survival Analysis.