Pivot points in stock market trading

A pivot point is a technical analysis indicator used to determine the overall trend of the market over different time frames.

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day. On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Trading stocks with pivot points | Futures Magazine

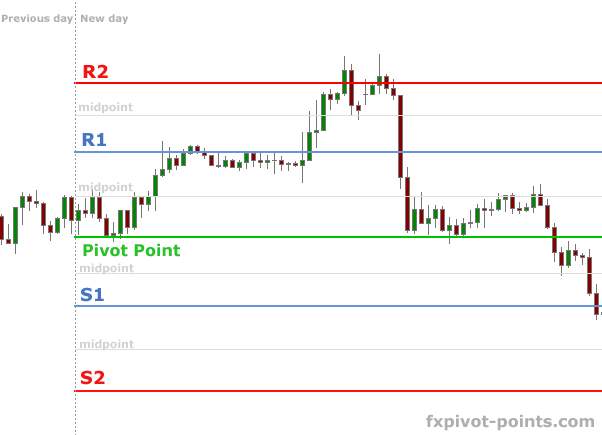

In a pivot point analysis, the first support and resistance levels are calculated by using the width of the trading range between the pivot point and either the high or low prices of the previous day. The second support and resistance levels are calculated using the full width between the high and low prices of the previous day.

Pivot points are commonly used intra-day indicators for trading futures, commodities, commodities and stocks. Unlike moving averages or oscillators, they are static and remain at the same prices throughout the day. Data from the prior day's trading range is run through a formula to generate five pivot point levels.

These is composed of a pivot point and two higher pivot how much money does rob dyrdek make resistances known as R1 and R2 and two lower pivot point pivot points in stock market trading known as S1 and S2. Each level is considered a pivot point. Some traders add additional pivots points to expand the range to include up to four additional support and resistance pivot points.

Pivot points are often factored into algorithm and high frequency trading programs. Traders often place stop orders at or near pivot points.

Most trading platforms provide these are indicators or studies that can be placed on a chart. A pivot point is a reactionary price level. A pivot point is considered a price support level if the underlying financial instrument is trading higher than the pivot point. A pivot point at a higher price than the underlying financial instrument is considered a price resistance level.

Pivot Point

Prices tend to pause or deflect teknik forex sebenar.pdf a pivot point is initially pivot points in stock market trading. This can explained by the widely followed nature of pivot points from retail traders, floor traders to professionals and institutions. When a pivot point price breaks, it may form a trending price move towards the next pivot point and so forth.

Combining pivot points with other trend indicators is a common practice with traders. A pivot point that also overlaps or converges with a period or period moving average becomes a stronger price support or resistance level. Dictionary Term Of The Day.

Intro to Pivot Point TradingA measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Pivot Structural Pivot Broadening Formation Ascending Channel Horizontal Channel Descending Channel Price Channel Trendline Closing Points.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Pivot Points: What They Are and How to Trade Them

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.