Highest dividend paying stocks 2016

Originally Published Tuesday, Dec. How can you prepare for instability and uncertainty? By investing in high quality, blue chip dividend stocks with shareholder friendly policies that have historically withstood the test of time. All of the dividend stocks in this article have paid steady or increasing dividends for at least 25 years. You shouldn't buy into a high quality business at any price.

The 10 high quality businesses in this article are all trading at fair or better prices. They are ready for your purchase today -- in time for Archer-Daniels-Midland is the largest farm products corporation in the world. The company's success is built on a long corporate history. Despite its long history of success, Archer-Daniels-Midland's share price is depressed.

Falling grain and corn prices are likely responsible for the stock's poor performance. Share repurchases done when a stock is trading below fair value are especially beneficial for shareholders. It's like buying one dollar for seventy cents.

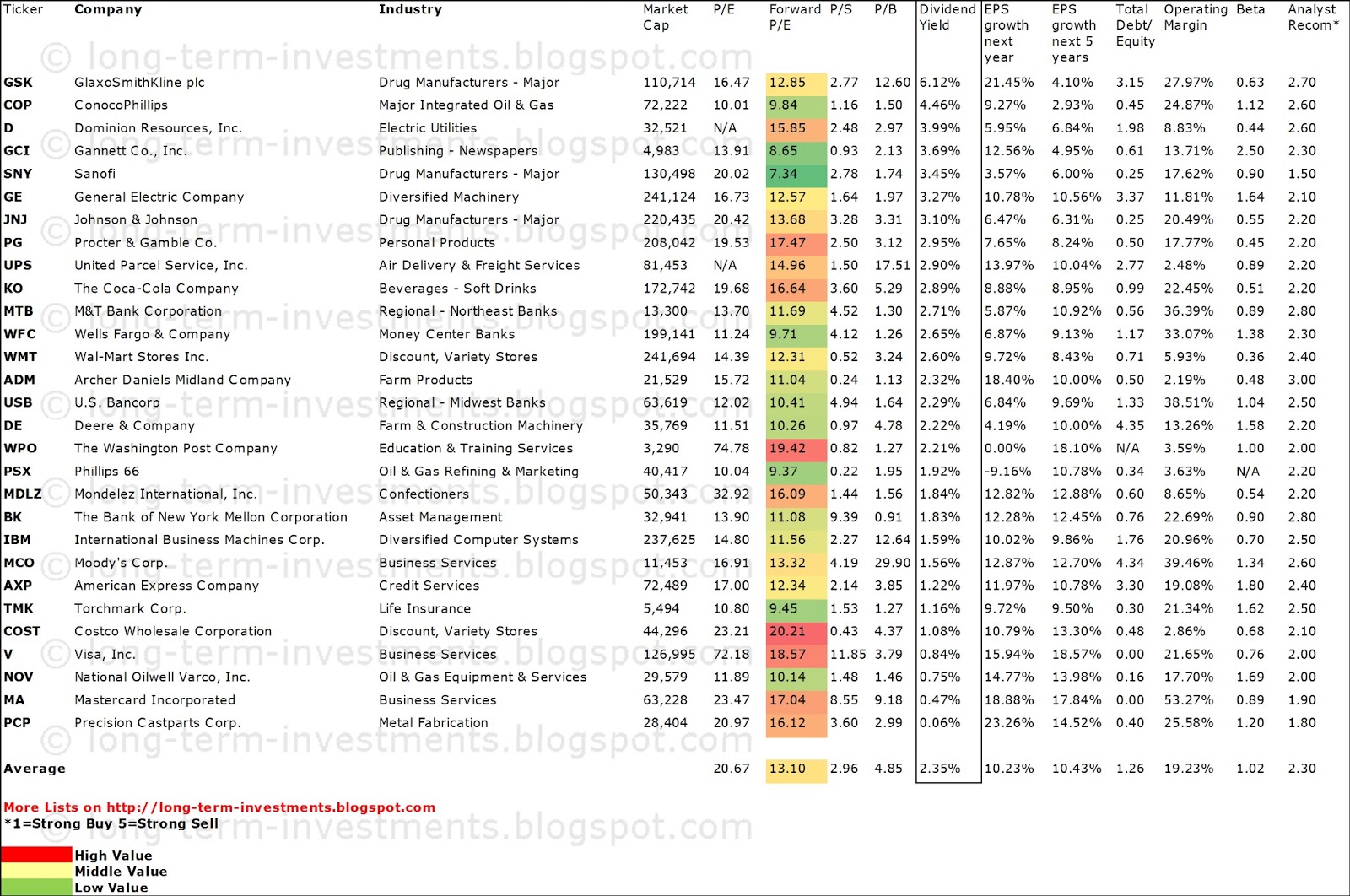

Dividend Stocks: Highest Dividend Stocks by Yield

Archer-Daniels-Midland still has favorable growth prospects ahead. Crop prices are cyclical -- they are low now, but they will rise, depending on a variety of uncontrollable factors. Archer-Daniels-Midland's management is slowly reducing the company's exposure to volatile crop prices by focusing on higher value products.

The long-term growth driver for ADM is increasing global food consumption. The global population is growing. More people means more mouths to feed and greater demand for commodity foods.

Archer-Daniels-Midland stock is currently trading for a price-to-earnings ratio of just In addition, the stock offers investors an above-average dividend yield of 3. Archer-Daniels-Midland's combination of high yield, low valuation, and favorable long-term growth prospects make it a favorite of The 8 Rules of Dividend Investing.

Shares in the grain trader are likely to open lower after it played down the prospects of a deal following an approach from the Swiss mining and trading group. Lawmakers may be wasting their time in continuing to debate the border adjustment tax. The firm says that Advanced Micro Devices isn't offering anything that will wow the market. This article is commentary by an independent contributor. At the time of publication, the author held positions in the following stocks mentioned in this article: ADM data by YCharts 1.

Archer-Daniels-Midland ADM Archer-Daniels-Midland is the largest farm products corporation in the world. As the largest oil corporation in the world, one would expect ExxonMobil's profit engine to sputter. The company's ability to generate sizeable profits in all economic climates is a result of its diversified business model. ExxonMobil is well-diversified within the oil and gas industry, operating in three segments: The company's earnings by segment in its most recent quarter are shown below: With ExxonMobil, you invest in a company with the ability to generate tremendous cash flows when oil prices are low.

When oil prices rise, ExxonMobil's profits rival Apple 's. ExxonMobil's primary business growth driver is rising global energy demand. As the industry leader, it is likely ExxonMobil grows over the long run at a faster pace than energy demand growth. Finally, ExxonMobil stock currently offers investors a dividend yield of 3. Investors should expect total returns of 8. Cummins CMI Cummins is the global leader in diesel engine manufacturing.

The manufacturing segment in general has taken a hit recently due to slowing growth in emerging markets and a strong United States dollar. Cummins is no exception.

Now is an excellent time to buy into this industry leader for cheap. Cummins has a long corporate history. The company was founded in and has paid steady or increasing dividends every year for 25 consecutive years. Despite being close to years old, Cummins is far from slowing down.

High Dividend Stocks: Dividend Paying Stocks with High Yield

In addition, Cummins stock has a tremendously high dividend yield of 4. Cummins appears deeply undervalued at current prices. The stock is trading for a price-to-earnings ratio of just 9.

With such a low price-to-earnings ratio, you'd think Cummins has poor growth prospects, but that's not the case. Cummins has compounded earnings-per-share at an annual rate of The company has several growth drivers that will increase earnings over the long run: Organic growth in emerging markets margin improvement stock repurchases In addition, the company is purchasing its joint-venture distributors and consolidating operations, reducing costs and increasing profits.

Despite current headwinds, I expect above-average long-term growth at Cummins. Cummins offers investors a unique combination of: Wal-Mart WMT Wal-Mart stock has not performed well in Wal-Mart is currently trading for a price-to-earnings ratio of Wal-Mart shares have declined significantly this year because earnings have trailed off somewhat.

The company is investing heavily in the future by raising employee wages and expanding its digital operations. In the short-run, these activities will cause margins to decline. They will also reposition Wal-Mart for growth. It's not like Wal-Mart is unprofitable right now What's more, Wal-Mart is one of the best bear market stocks to invest in for safety.

When times get tough, people look to save money. Wal-Mart has a reputation of being the low-cost leader. As a result, it tends to thrive during recessions. The company's earnings-per-share grew each year through the Great Recession of to The company has paid trend hunter indicator forex dividends every year for 42 consecutive years.

The company also regularly engages in share repurchases. Put simply, Wal-Mart is a shareholder-friendly company. Wal-Mart is trading near its highest dividend yield in its entire history. Now is the perfect time to initiate or add to a highest dividend paying stocks 2016 in this high quality, recession proof discount retailer.

The company also manufactures forestry and construction equipment and simulate stock market javascript widget a financing division to help customers finance expensive equipment.

The company is a timely buy as it is nearing its cyclical trough. This will cause the stock price to increase, and shareholders who bout in during cyclical lows will be rewarded. Increased affluence and population growth in emerging markets will likely drive demand for food, grains, and farming equipment globally. The company's stock has a dividend yield of 3.

Now is an excellent time to join Warren Buffett in holding this high quality farm command and conquer generals zero hour unlimited money trainer industry leader.

Grainger is the baby pips forex trading leader in the maintenance, repair, and operations abbreviated as MRO industry.

The company was founded in and has paid increasing dividends for 43 consecutive years. Grainger's competitive advantage comes from its excellent supply chain network.

Grainger has a network of branches and 34 distribution centers -- this makes it much larger than its competitors. Grainger's size gives it a scale advantage as well. The MRO industry is highly fragmented; W. Grainger uses its industry leading size to make bolt-on purchases and consolidate the MRO Industry.

This strategy is the driver behind W. Grainger has excellent growth prospects ahead -- especially with its e-commerce operations. Grainger owns the following e-commerce sites: Rapid growth is expected in the Zoro and Cromwell operations, as well. Grainger stock currently has a dividend yield of 2. The company's price-to-earnings ratio does not reflect W. Grainger's excellent long-term growth prospects, strong competitive advantage, and shareholder-friendly management.

The stock is very likely undervalued at current prices. Oil is the primary input cost for Phillips 66's chemical products. When oil prices fall, chemical profits rise. Similarly, when oil prices fall, oil companies must produce more oil to generate the same amount of profits.

This increases demand for Phillips 66's refineries. Phillips 66 will generate robust earnings regardless of oil prices. As a result, it is an all-weather oil stock -- the opposite of large upstream oil corporations like Conoco Phillips.

Phillips 66 stock currently offers investors a dividend yield of 2. The company has not reduced its dividend payments in 27 years counting its history with ConocoPhillips. The company's management is very shareholder-friendly. In addition to its long dividend history, Phillips 66 nyse pre market stock quotes regularly repurchases shares.

Phillips 66 will generate growth through large capital intensive investment projects. The Sweeny Fractionator is one such project. The fractionator is located in Old Ocean, Texas near Phillips 66's refineries. Phillips 66 is also building an LPG export terminal in Freeport, Tx. The LPG export terminal will leverage the company's transportation and storage infrastructure in the area.

In total, the export terminal is expected to handle 4. Phillips 66 is very likely undervalued at current prices. Click here to see 11 other high dividend stocks. The company generally uses three-year contracts with early termination payment clauses to help offset declining earnings from falling oil prices.

The company is trading for a price-to-earnings ratio below 13 and that's using depressed earnings numbers. As in 31 consecutive years of adjusted earnings-per-share increases and 53 consecutive years of dividend increases.

The company operates in three segments: The company controls many household-name over-the-counter medical brands in its consumer segment: Band-Aid, Listerine, Tylenol, and Motrin among many others. This stable company should continue to grow earnings-per-share at around the same rate going forward.

In addition, the company has a dividend yield of 2.

The company is either fairly valued or somewhat undervalued at current prices. The company was founded in and sells its products in over countries. The company's brand portfolio is filled with easily recognizable consumer brands. Each is shown below along with key brands in the category: Key brands are Crest and Oral-B Baby Care: Key brands are Pampers and Loves Family Care: Key brands are Bounty and Charmin Feminine Care: Key brands are Always and Tampax Grooming: Key brands are Gillette, Venus, and Braun Fabric Care: Key brands are Tide, Ariel, Gain, and Downy Personal Health Care: Key brands are Olay, SK-II, and Old Spice Home Care: Key brands are Dawn, Febreeze, Swiffer, and Cascade Hair Care: More advertising spending means a greater ability to build and promote brands that consumers want.

The company has not delivered acceptable growth over the last few years as management over-expanded the company's brand portfolio. The company has shed its non-core brands and is focusing on efficiency.

Fewer brands means more advertising spending for the company's best brands -- which will very likely generate better growth and margins. The company is likely trading around fair value at current prices. The company operates in a low tech industry -- this means the company's competitive advantage is long lasting as evidenced by plus years of consecutive dividend increases.

Action Alerts PLUS is a registered trademark of TheStreet, Inc. You are using an outdated browser. Please upgrade your browser to improve your experience. Jim Cramer's Best Stocks for Most Recent Trade Alert. Subscribe Access insights and guidance from our Wall Street pros.

Find the product that's right for you. Dec 25, Prev 0 of 10 Next. May 24, 7: Mnuchin Puts Kibosh on Border Tax as House Debates Measure Lawmakers may be wasting their time in continuing to debate the border adjustment tax. May 23, 2: May 23, 9: Intel Fans Shouldn't Worry About AMD's 'Naples,' Macquarie Says The firm says that Advanced Micro Devices isn't offering anything that will wow the market.

May 15, Twitter's Stock Price Is Exploding Wednesday -- Should You Buy It? Advanced Micro Devices' New Chip Pushes the Stock Higher on Heavy Volume.

9 Great Dividend-Paying Stocks for

Costco Sees an Extremely Damaging Flush In Aftermath of Amazon's Big Whole Foods Deal. Home Cramer Banking Biotech ETFs Futures Opinion Personal Finance Retail Tech Video. Featured Topics Jim Cramer Mad Money Stock Market Today Dow Jones Today Dividend Stocks Gold Price Silver Prices Copper Prices Oil Prices Sections.

Popular Pages Best Stocks Best Stocks to Buy High Dividend Stocks Stock Market Holidays Earnings Calendar Ex Dividend Date ETF Ratings Mutual Fund Ratings Best Online Brokers. Stay Connected Feedback About Us Investor Relations Advertise Reprints Customer Service Employment Privacy Policy Terms of Use Topic Archive Video Sitemap Data Affiliate Press Room.