Forex indicators and strategies

Traders across countries, cultures and economic strata get together at the common currency platform world over to try their hands in harnessing the force of the forex market. The hundreds of traders across the world employ many separate sets of parameters to gauge the market sentiment and how best to catch the trend to maximize their returns from the currency market.

While some look at the average volume, many take cues from the momentum trends. There are several others who would depend on the swings and the resultant price action. Given the abundant liquidity and scope of trade across time zones, news trigger and absence of a centralized regulatory body, no one method can be isolated and decided as the best.

Yet there are some ground rules. Basic forex market analysis can be divided under two heads, technical and fundamental analysis. Though there are many varied approaches in technical analysis too, you must remember that the daily chart is your primary tool, and most strategies are based on it.

How you interpret the charts could surely be unique and different, but the charts essentially have a fundamental bearing on your analysis outlook. So before we get any further into the analysis of the various types of strategies that we could employ using the daily charts, it is essentially to get a good understanding of what we understand by a daily time frame or a daily chart in the forex market context.

Only a proper understanding of the daily chart will enable effective interpretation. Daily chart or time frame is almost the most popular among professional traders, because it summarizes the whole day events , the open, high, low and close prices. With a potential to offer deep insight into the daily market trade, they give you an important perspective about the valuation and the fair value of the specific entity that is being charted. The daily charts give the trader a fair idea of the trend that might be underway and comparative study of charts over a few days clearly indicates the bias in the market.

In other words, it is perhaps one of the easiest ways to befriend the trend in the market. A strong signal on the daily chart can show you the direction of the market for the next several days, weeks or even months.

Also, price action in the daily charts is an ideal indicator for swings, especially the short-term ones that day traders look at to execute their strategies. So both swing and short term traders find a fairly vivid representation in the daily charts: I Trade the Daily Chart, But I Am a Day Trader. Therefore, as you can imagine, this kind of charting is particularly useful for day traders who can employ this data for executing short to medium term strategies.

For the sake of convenience of those who are plotting and all those who are using this information, a forex day is generally from 5 pm EST of one day to same time next day. As a result of this convention, charting becomes fairly simple, and the action can be broken down into smaller tranches instead of one continuous graph which could be both confusing as well as cumbersome to deal with. So, that takes us to the next stop as to how we can use the daily charts in specific strategies for better trading success across the forex market.

The candlestick chart patterns cover a broad cross section of many different kinds of charts. Here is a look at some of the most commonly traded patterns using the daily charts:. This one has two key candles, the white one engulfing the black one in case of bullish charts. The opposite happens in the case of bearish sign where the black engulfs or outsides the white one.

Hammer forms at the bottom of bear markets and Shooting Star at the top of bull markets. This particular candlestick is perhaps one of the clearest indicators of market swing. In the case of a bullish Harami, you have a long black candle followed by short white one denoting improvement in sentiment. The exact opposite happens in case of a bearish one. This one indicates potential reversals in the market.

This too involves two candles to bring out the exact trend in the market. The bearish candle pattern is almost the mirror image and is known as dark cloud cover.

Top Technical Indicators For A Scalping Trading Strategy | Investopedia

In this one, sellers take control on day two. This one is a very commonly used candlestick chart pattern and signals indecision and rangebound market action. Many a times a Doji could also be seen as the catalyst triggering potential reversal in the forex market. This is a multiple candle pattern that can have both bullish and bearish patterns. In this day, two sees gap-up opening for the entity in case of a bullish kicker. The sellers are almost forced to cover shorts and make way for new traders with a long bias.

The bearish kicker is the complete reverse of the bullish variant. Learn more about candlestick patterns here. From swing indicators, we now graduate to volume indicators based on the same daily charts.

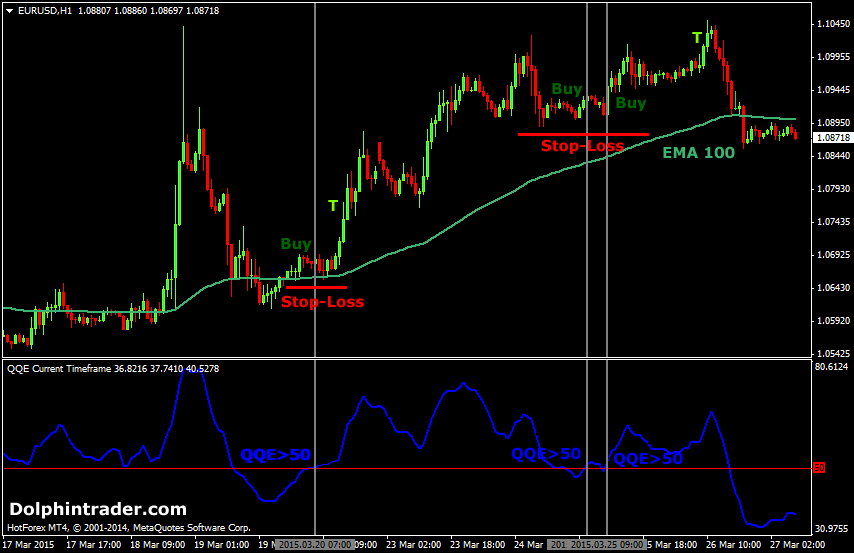

Moving averages constitute one of the oldest type of forex market analysis using technical tools. Very commonly used by traders, it helps in reducing the noise in chart patterns and enables you to interpret real-time rates.

Moving averages are best known as indicators of the trend reversal and timing buying and selling of positions in the forex market using the daily charts. The day Moving Average is one of the most popular variants with a high degree of accuracy rate in identifying trends. It is also considered as the ideal measure of the health of the overall market based on the number of entities trading above this crucial mark.

This also is extensively used for identifying the support and resistance levels during a particular trading session using the daily charts. These also form the basis of long-term chart trends seen in the market. The other commonly used variant of a moving average is the Day Moving Average.

This is a very important chart as it also acts as the dividing line between the healthy and unhealthy market entities. Higher the number of currencies trading above this crucial line, better the chances of an overall improvement in sentiment across forex market. The day moving average also acts as an important indicator of the entry and exit points in the market for forex traders. It gives a fair idea about the kind of price range that one should enter to constructively add to profits and the price range where it is best for traders to exit to minimize the loss or preserve the existing profit levels:.

Bollinger Bands is the next key strategy on our radar. It uses the daily charts to assess the volatility level of a specific currency pair that is under consideration. Volatility forms an important trading catalyst and a sudden change in it could have long-term implications on the trading positions. Also, the volatility trends most times are also precursor of potential trend reversals in the market.

The Bollinger Bands thus when placed above a daily price chart along with a moving average gives you a fair view of the pricing channels. What the Bollinger bands do is add bands over and under the basic moving average line to give shape to a certain limit or rate of upper and lower boundaries that then become strong measure of the overall market volatility:. The next key strategy, that extensively uses the daily chart, is the RSI or the Relative Strength Index.

Essentially a momentum indicator in the forex market, the RSI was first introduced by Wells Wilder.

It responds to the changes in the market rate and oscillates in tandem with this change in pricing. Its key function includes a study of oversold and overbought market conditions in forex trade. A reading of 30 and below conveys oversold positions while that of 70 and above indicate overbought market position. This enables traders to identify potential rate changes and prepare for a reversal that is in the making:.

The MACD or the Moving Average Convergence and Divergence is considered as one of the most reliable forex market indicators using the daily charts. While candlesticks and Bollinger Bands continue to be the key tools to identify trade set ups, the MACD charts act as the safety valve for traders and prevent getting in or exiting a trend too early.

This is useful especially for those who are new to forex trade. The fact that the MACD is a lagging indicator adds to its key charms. While the patience, that it expects you to exercise, can be at times frustrating but this also acts as your secret weapon while dealing with false breakout or sudden rallies in the market. Though not exactly a magic tool, it acts as one of the most reliable indicators of the buy sell signal in the forex market.

Four Highly Effective Trading Indicators Every Trader Should Know

When used along with the RSI, it forms as a key tool to identify trend setups in the forex market:. This is one of those trading strategies using the daily charts that work best when the forex market is trending.

Free Forex Trading Strategies and Trading Systems

The basic idea that is conveyed by the Fibonacci retracement levels indicates that traders must go long in case of a retracement of the Fibonacci support point in an upward trending market and one should go short when the retracement of the resistance level is seen in a market that is trending lower. Many traders also use the Fibonacci retracement levels for identifying resistance and support levels for key currency pairs that they might be trading in.

Given the huge trading activity at these support and resistance zones they become prominent tools to identify trends and market direction themselves.

Many a times it also becomes the ideal tool to decide on levels of profit booking: Fibonacci Trading — How To Use Fibonacci in Forex Trading. Thus, the daily chart is both the enabler and facilitator of creating useful and profit generating trading strategies in the world of forex trading. They serve the role of a record keeper tracking every single pip movement that is traded anywhere across the world. Given the global reach and the non-stop trading hours, the daily chart becomes almost the foundation stone for basing long-term currency moves and generating revenue through firm strategy takes.

In the absence of many complicated tools to gauge the direction of market, they can be the platform to base both short-term as well as long-term strategies.

Another interesting element that a daily chart throws up is the value of details. Normally on the weekly or monthly chart many times you tend to miss out on small moves that seem insignificant in the bigger picture but might play a key role in the way the eventual market pans out.

The daily chart leaves no room for such misses. In a nutshell, therefore, there is a huge range of strategies across varying parameters that you could execute using the daily chart. Your ultimate profit target and investment horizon is what plays a key role in deciding what weapon you pick up for your trade.

But yes, the efficacy of a strategy will ultimately depend on how aware you are about the market conditions you are investing in and how careful you are in terms of maintaining the right level of leverage and keeping your stop losses in place. Ultimately these are the two safety valves that ensure that your ship is sailing even when the tide takes a turn for the worse.

Thank you so much for sharing your knowledge through this site. This is a great gist of all the learnings spread across the several articles of this blog! When I read about the Candlesticks I cant help but relate them to the Price Action method of trading being popularized by other blogs.

Chris, Been reading this article once again to re-iterate my basics. You said, the Moving Averages are Volume Indicators. Can you elaborate a bit more on how these indicate volume? However, when moving averages like 50 or take a special direction sharply, it means the volume of the money flooded in the market is increased. But if I understood right even the Stop Loss will not safe you from loosing entire account.

In this case volatility is so high, broker can not find byers. Good to see you putting out free content to assist others. They have to do their own due diligence if they want to use what you offer on your site. Get Our New E-Books For Free. Forex Indicators , Trading Strategies Last Updated: Enter Your Email Address and Check Your Inbox: LEARN A PROVEN BUSINESS PLAN.

January 13, at 1: January 14, at January 13, at 3: January 13, at 5: January 14, at 9: January 24, at 2: March 19, at March 20, at 3: The Easiest Way to Get Rich Fast. Learn How to Get a Job with Mississippi Department of Employment Security Reaching What You Want without Doing Anything Candlesticks or Support and Resistance Levels?

Making Excuses Is the Only Thing Some People Do How to Write a Business Proposal for the Business You Want to Start Recent Comments LuckScout on What Is Data Technology and How It Can Make You a Millionaire?

Joseph Kolade on What Is Data Technology and How It Can Make You a Millionaire? LuckScout on What Is Data Technology and How It Can Make You a Millionaire? Abata Moses on What Is Data Technology and How It Can Make You a Millionaire? Success Business Blogging Trading Investment. Home LuckScout Mementos Contact About Archive Privacy Policy Terms. This Is More Important Than the Article You Are Reading:.

Are You Enjoying Our Site? Our eBook Is Even More Important!