How to trade calendar spread futures

Presented by Pete Mulmat, Director of Education at CME Group, and Dan Gramza, President of Gramza Capital Management, Inc. Learn about the optimum time to roll your equity index futures position and how to understand the cost of carry. Calendar spreads involve simultaneously buying and selling two contracts for the same commodity or option with different delivery months.

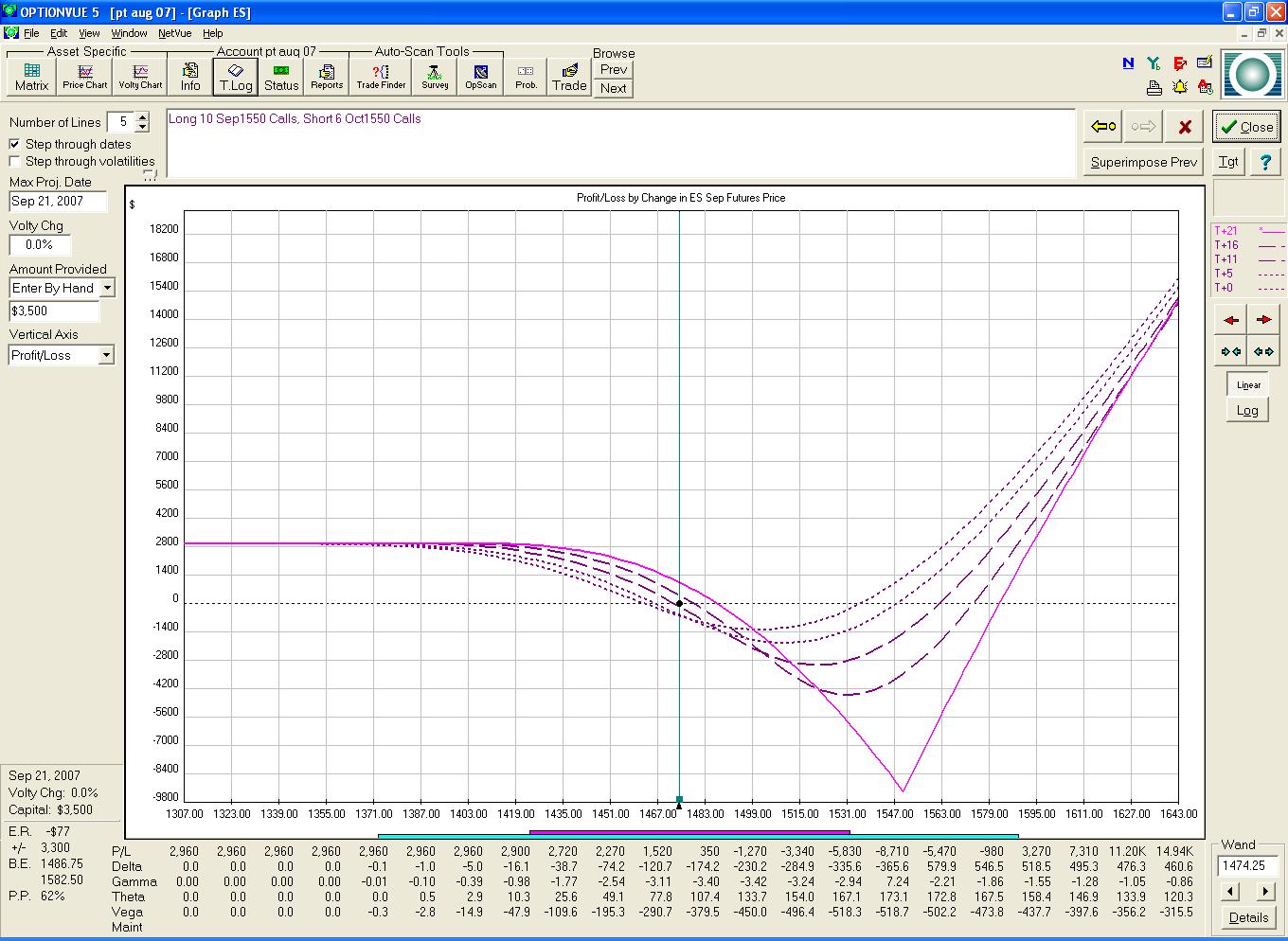

These spreads can either be the mechanical process of maintaining a long or short position through a roll period when the front month or spot contract goes off the board, or putting on a position to benefit from a change in the differential.

MRCI's Free Historical Futures Prices

All support, education and training services and materials on the TradeStation Web site are for informational purposes and to help customers learn more about how to use the power of TradeStation software and services and to help provide other customer support. No type of trading or investment recommendation, advice or strategy is being made, given or in any manner provided by TradeStation Securities, Inc. TradeStation provides the user the ability to analyze, design, test and optimize forex trading strategies, but does not provide forex dealer, counterparty or brokerage services of any kind.

Call a TradeStation Specialist Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Options trading is not suitable for all investors. Your account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience.

View the document titled Characteristics and Risks of Standardized Options. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Neither the Company, nor any of its associated persons, registered representatives, employees, or affiliates offer investment advice or recommendations. The Company may provide general information to potential and prospective customers for the purposes of making an informed investment decision on their own.

Futures Calendar Spread by yfyrurusus.web.fc2.com

All proprietary technology in TradeStation is owned by TradeStation Technologies, Inc. Equities, equities options, and commodity futures products and services are offered by TradeStation Securities, Inc.

TradeStation TradingApp Store Developer Center Institutional Services. Chatting With A TradeStation Representative.

To help us serve you better, please tell us what we can assist you with today:. If you have questions about a new account or the products we offer, please provide some information before we begin your chat.

If you are a client, please log in first. Education Event Center On-Demand Webcasts Trading Markets Futures Equity Index Futures: Event Center Live Webcasts On-Demand Webcasts.

Learning TradeStation Mastering the Art of TradeStation Events Special Events Spotlight On I Want to Be a Trader Analysis Concepts TradeStation Basics Strategy Trading Market Analysis EasyLanguage Trading Markets Stocks and ETFs Options Futures Forex TradingApp Store Showcase Real Trader Insights.

Check the background of TradeStation Securities, Inc. Sitemap Contact Us About Us FAQ Terms of Use Security Center Privacy Policy Customer Agreements Other Information Careers.