Disadvantages of futures trading

Futures trading is attractive because of the diverse array of commodity and financial products with futures contracts and the very liquid market in many futures. Futures traders can make profits on short- to medium-term moves in commodities like corn, soybeans, oil and gasoline, as well as stock indexes, interest rates, currency exchange and bonds.

For new or unfamiliar traders, however, there are some distinct disadvantages to futures trading. Futures contracts can be bought or sold with a margin deposit that is typically 5 to 10 percent of the contract value.

This means that futures provide a leverage ratio of from to-1 to to-1 on the price movement of the underlying commodity or instrument.

The Advantages of Trading Options vs. Futures | Finance - Zacks

If a trader picks the wrong direction for a futures contract, he can lose a large portion or all of the margin deposit in a very short time. The high level of leverage offered by futures trading is a double-edged sword, and the trader must be able to monitor her trades at all times and be ready to close the trades before losses get too large.

Futures contracts are complicated and can be difficult for new traders to understand. Each contract has a different size and different price movement amounts.

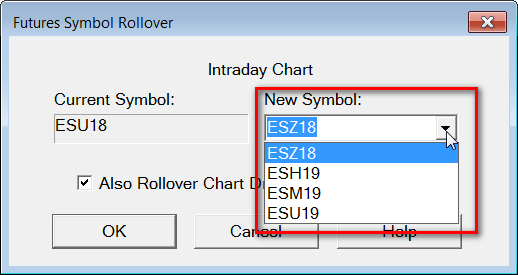

Traders also have to understand final trading dates and possible delivery options.

Futures are also traded only with brokers that are registered with the Commodity Futures Trading Commission, and cannot be traded with regular stock brokers. Many commodities have a daily limit on how much the price can change. If a commodity value is changing rapidly, it will quickly reach the limit price each day and traders will not be able to continue trading. A futures trader who is caught on the wrong side of a trade making limit moves every day may be stuck in the contract with few options to stop the losses.

Futures contracts are for large amounts of the underlying commodity or instrument.

Five Advantages of Futures Over Options | Investopedia

Even though the margin requirement is a small percentage of the contract value, the dollar amount can be large for new investors. These amounts can be too large for the new trader trying to learn futures trading.

Trading Futures Contracts

The Disadvantages of Futures Trading. Share Share on Facebook.

Wheat is one of many possibilities for futures trading. McDonald's Is Now Hiring People Via Snapchat Investing.

Can You Guess the Richest County in America? You May Be Paying More in Taxes Than You Actually Owe. SEBI Guidelines for the Primary Market Investing.

Five Advantages of Futures Over Options | Investopedia

How to Calculate Stock Price Appreciation Investing. How to Deposit Money on E-Trade to Buy and Sell Stocks Investing. Please enter a valid email.