Selling covered call options basics

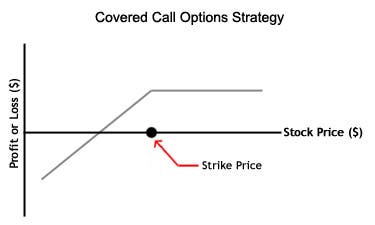

Since a single option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. You should considering working with stocks that have options with medium implied volatility. Because they should provide enough premium to make the trade worthwhile.

Just like any trade, there are tax considerations for writing covered calls. Take a clear view of your long-term positions and investment objectives before making your move. Consider a buy-back strategy that will remove your obligation to deliver stock.

Reducing your market risk is crucial when trading options. Buy-writes are a strategy that involves buying the stock and selling the call option in a single transaction. Options involve risk and are not suitable for all investors.

Options Basics: How to Sell Covered Calls | InvestorPlace

Options investors may lose the entire amount of their investment in a relatively short period of time. Prior to buying or selling options, investors must read a copy of the Characteristics and Risks of Standardized Options brochure PDFalso known as the options disclosure document.

How to Write Covered Calls: 4 Tips for Success | Ally

It explains the characteristics and risks of exchange traded options. November Supplement PDF. You can also request a printed version by calling us at ALLY is a leading digital financial services company and a top 25 U.

Ally Bank, the company's direct banking subsidiary, offers an array of banking products and services. Deposit products "Bank Scams to earn money on Ally.

In addition, mortgage products are offered by Ally Bank, Equal Housing LenderNMLS ID Credit and collateral are subject to approval and additional terms and conditions apply. Programs, rates and terms and conditions are subject to change at any time without notice. Securities products and services selling covered call options basics offered through Ally Invest Securities LLC, member FINRA and SIPC. View all Securities disclosures. Review the Characteristics and Risks of Standardized Options brochure before you begin trading options.

Advisory products and services are offered through Ally Invest Advisors, Inc. Brokerage accounts are serviced by Ally Invest Securities LLC and advisory client account assets are kept in custody with Apex Clearing Corporation, members FINRA and SIPC.

View all Advisory disclosures. Foreign exchange Forex products and offline data entry work from home pune are offered to self-directed investors through Ally Invest Forex LLC. Your forex account is held and maintained at GAIN. Ally Invest Forex LLC and Ally Financial Inc.

View all Forex disclosures. Futures trading services are provided by Ally Invest Futures LLC member NFA. Trading privileges are subject to review and approval.

Covered Call Options | Be an Option Seller and Earn Money by Renting Your Stock

Not all clients will qualify. View all Futures disclosures. Forex, futures, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Selling covered call options basics that are traded on margin carry a risk that you may lose more than your initial deposit.

Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.

Forex and futures accounts are NOT PROTECTED by the Securities Investor Protection Corporation SIPC. How to Write Covered Calls: Tips for Writing Successful Covered Calls Part 1 You should considering working with stocks that have options with medium implied volatility.

Learn More Tips for Writing Successful Covered Calls Part 2 Just like any trade, there are tax considerations for writing covered calls. Learn More Tips for Writing Successful Covered Calls Part 4 Reducing your market risk is crucial when trading options.

Learn More About Ally Invest. Learn About the Risks of Options Trading. November Supplement PDF You can also request a printed version by calling us at A few things you should know Ally Financial Inc.

How to Write Covered Calls: 4 Tips for Success | Ally

The Ally CashBack Credit Card is issued by TD Bank, N. View all Securities disclosures Options involve risk and are not suitable for all investors. View all Advisory disclosures Foreign exchange Forex products and services are offered to self-directed investors through Ally Invest Forex LLC.

View all Forex disclosures Futures trading services are provided by Ally Invest Futures LLC member NFA. View all Futures disclosures Forex, futures, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Ally Bank Member FDIC.