Good risk reward ratio forex

What is the Number One Mistake Forex Traders Make?

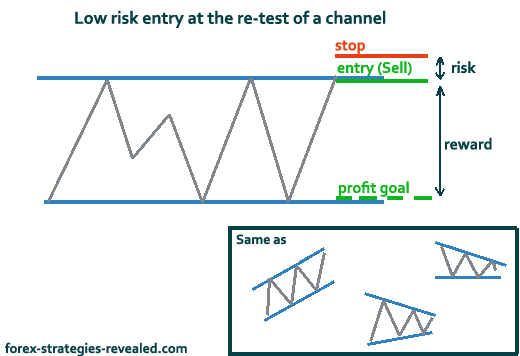

Most traders believe that in order to have a great risk reward ratio on their trades, they need to have a tight stop — or at least as tight as possible. This makes sense of course. If you risk 30 pips to gain pips, your risk reward ratio is better than if you risk pips for the same pips Of course, the tighter the stop, the more you get stopped out, the more losers you have, and the more difficult your trading system is to trade without mistakes. But first, a brief detour into the psychology of stop-losses and the need to be right.

Most traders are obsessed with being right. But when they actually trade they are trying desperately to be correct on their entries.

If you have a tight stop loss, you do by definition need to be very accurate with your entry level. Otherwise you will get stopped out. Probably, you focus much of your energy on analysis techniques before you get into the trade. By the way, I know this is true. I see all the stats about my blog posts. The ones about entries are some of the most popular — even if they are no more important than any other topic.

The funny thing is: Probably because my stops are wide. This is not a fancy method. Using this technique, you can turn a trade that might have a risk reward ratio of 3: With no extra risk.

Risk / Reward - The Holy Grail of Forex Money Management » Learn To Trade

I am a longer term trader, but I have used this on 15 minute charts to good effect. Feel free to adapt it to your trading style. On the shorter-term timeframes, you may want to have an even wider stop-loss relatively speaking.

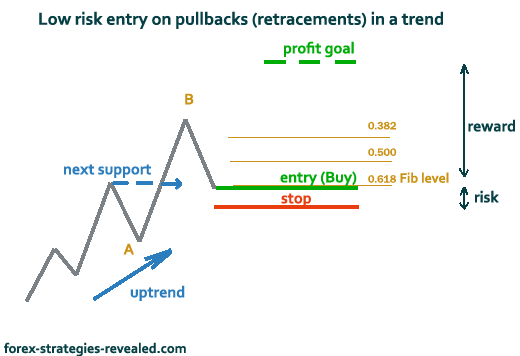

Firstly, you still want to stalk a good entry. Preferably, you also want a catalyst that triggers the trade.

Forex Risk Reward Ratio

When you get your entry signal, establish your initial position as you would normally — but make sure you keep your stop-loss well out of the way of any noise.

Try tripling what you normally use.

By the way, another benefit of this approach is that you can tend to trade larger positions, as the quality of your trades goes up. This means your profits can be greater. As the market goes for you, scale in to an additional position. You will want it to have gone another pips. Preferably, you want to stalk another good entry point for the new position.

When you add the additional position, combine the stops and move them up jointly so that you are risking no more than the original amount of money. As you had some profit from the first position, you will still be able to maintain a wide stop, even though your position size is twice as large. Your risk reward is 6. You can put the profit target on the second position at the same place as the original position if you like.

But having only one profit target is trying to be right about the exit. Better to have multiple targets, and other exit rules that cater for changing market conditions not all trades go as swimmingly well as this one.

Risk Reward Ratios for Forex

Once you have added the second position, keep adding as the price goes for you until you reach your maximum position size. For example, on a trade like this, you might look to add up to five positions as it goes for you. Each new position gives you an additional 3. This is what I call trade implementation. You are not simply looking for an entry. You are anticipating a move, and building a good risk reward ratio forex that minimises the risk and maximises the reward if the expected move does happen.

Trend hunter indicator forex course, there are some intricacies with this approach, and on occasion you may have to give back a good chunk of the profit you have made on a position though there are ways to minimize that. There are also lots of different ways you can adjust this method to suit your psychology.

Learning how to apply an approach like this is a continual process of testing and practice with your own trading system. Sam Eder is a macro currency trader and co-owner of FX Renew, a provider of premium Forex signals from ex-bank and hedge fund traders.

/about/Risk-Reward-56a31bb05f9b58b7d0d06341.jpg)

He is author of the Advanced Forex Course for Smart Traders. Registration is required to ensure the security of our users. Login via Facebook to share your comment with your friends, or register for DailyForex to post comments quickly and safely whenever you have something to say.

Log in Create a DailyForex. Want to get in-depth lessons and instructional videos from Forex trading experts? Register for free at FX Academy, the first online interactive trading academy that offers courses on Technical Analysis, Trading Basics, Risk Management and more prepared exclusively by professional Forex traders. DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including good risk reward ratio forex news, analysis, trading signals and Forex broker reviews.

The data contained in this website is not necessarily real-time nor accurate, free essay on the stock market game analyses are the opinions of the author and do not represent the recommendations of DailyForex or its employees. Currency trading on margin involves high risk, and is not suitable for all investors.

As a leveraged product losses are able to exceed initial deposits and capital is at risk. Before deciding to trade Forex or any other financial instrument you should carefully consider your investment objectives, level of experience, and risk appetite.

We work hard to offer you valuable information about all of the brokers that we review. In order to provide you with this free service we receive advertising fees from brokers, including some of those listed within our rankings and on this page. While we do our utmost to ensure that all our data is up-to-date, we encourage you to verify our information with the broker directly.

Forex Reviews Forex Brokers Reviews Bitcoin Forex Brokers ECN Forex Brokers US Forex Brokers UK Forex Brokers Canadian Forex Brokers Australian Forex Brokers Singapore Forex Brokers South Africa Forex Brokers Islamic Forex Brokers Regulated Forex Brokers MT4 Forex Brokers Mobile Trading Brokers Social Trading Platforms. Oil Trading Brokers Gold Trading Brokers NFA Regulated Brokers Automated Forex Trading More In Reviews Forex Brokers By Type Forex Signals Reviews Forex Products Reviews Forex Courses Reviews Forex Brokers Bonuses Binary Options Brokers Full Brokers List.

Forex News Technical Analysis Fundamental Analysis Trading Mind Blog Forex Blog Financial Humor Forex Expo Forex Newsletter More Technical Analysis Weekly Forex Forecast Free Forex Signals Gold Price Forecast. Analysis By Pair EUR-USD USD-JPY GBP-USD USD-CHF USD-CAD AUD-USD Bitcoin-USD Gold Oil.

How To Choose a Broker Guide Learn Forex at FXAcademy Forex Articles Binary Options Trading Forex Social Trading Guide Forex Glossary Forex Basics Forex Webinars Forex Regulations.

DailyForex Mobile App Need Help Choosing a Broker? Report Broker Scams Forex Widgets Sitemaps. Sam Eder Most traders believe that in order to have a great risk reward ratio on their trades, they need to have a tight stop — or at least as tight as possible. The unnecessary preoccupation with being right Most traders are obsessed with being right.

No fancy techniques here This is not a fancy method. Let me use an example of a longer-term trade on the EURUSD. See the course below for more in-depth lessons.

Over to you… Learning how to apply an approach like this is a continual process of testing and practice with your own trading system. How will you apply this lesson to what you do? About the Author Sam Eder is a macro currency trader and co-owner of FX Renew, a provider of premium Forex signals from ex-bank and hedge fund traders.

Sign Up Read Review. Free Forex Trading Courses Want to get in-depth lessons and instructional videos from Forex trading experts? Sign up to get the latest market updates and free signals directly to your inbox.

Most Visited Forex Broker Reviews. About Us Contact Us. Enter your email address here: