Recession effect on stock market

Movements in the stock market can have a profound economic impact on the economy and everyday people. A collapse in share prices has the potential to cause widespread economic disruption. Most famously, the stock market crash of was a key factor in causing the great depression of the s.

Yet, daily movements in the stock market can also have less impact on the economy than we might imagine. Instead, low interest rates caused a boom. Plummeting share prices can make headline news. But, how much should we worry when share prices fall? How does it impact on the average consumer? The first impact is that people with shares will see a fall in their wealth. If the fall is significant it will affect their financial outlook. If they are losing money on shares they will be more hesitant to spend money; this can contribute to a fall in consumer spending.

However, the effect should not be given too much importance. Often people who buy shares are prepared to lose money; their spending patterns are usually independent of share prices, especially for short term losses.

The wealth effect is more prominent in the housing market. Anybody with a private pension or investment trust will be affected by the stock market, at least indirectly. Pension funds invest a significant part of their funds on the stock market.

Therefore, if there is a serious fall in share prices, it reduces the value of pension funds.

The Effects of Recession on the Stock Market | yfyrurusus.web.fc2.com

This means that future pension payouts will be lower. If share prices fall too much, pension funds can struggle to meet their promises. The important thing is the long term movements in the share prices. If share prices fall for a long time then it will definitely affect pension funds and future payouts. Often share price movements are reflections of what is happening in the economy. The stock market itself can affect consumer confidence. Bad headlines of falling share prices are another factor which discourage people from spending.

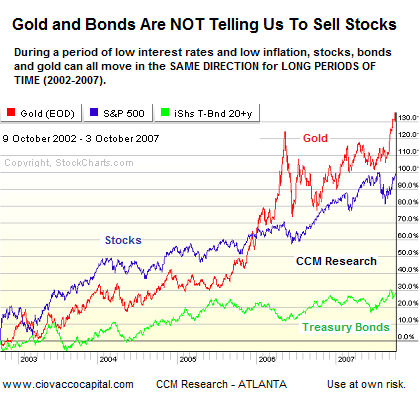

On its own it may not have much effect, but combined with falling house prices, share prices can be a discouraging factor. However, there are times when the stock market can appear out of step with the rest of the economy. In the depth of a recession, share prices may rise as investors look forward to a recovery two years in the future.

Falling share prices can hamper firms ability to raise finance on the stock market. Firms who are expanding and wish to borrow often do so by issuing more shares — it provides a low cost way of borrowing more money. However, with falling share prices it becomes much more difficult. A fall in the stock market makes other investments more attractive.

People may move out of shares and into government bonds or gold. These investments offer a better return in times of uncertainty. Though sometimes the stock market could be falling over concerns in government bond markets e. Most people, who do not own shares, will be largely unaffected by short term movements in the stock market. However, ordinary workers are not completely unaffected by the stock market.

Many private pension funds will invest in the stock market. A substantial and prolonged fall in the stock market could lead to a fall in the value of their pension fund, and it could lead to lower pension payouts when they retire.

Similarly, if the stock market does well, the value of pension funds could increase. The stock market could be a source of business investment, e. This could lead to more jobs and growth.

The stock market can be a source of private finance when bank finance is limited. However, the stock market is not usually the first source of finance. Most investment is usually financed through bank loans rather than share options. The stock market only plays a limited role in determining investment and jobs.

Does stock market decline signal a recession? - The San Diego Union-Tribune

It could be argued workers and consumers can be adversely affected by the short-termism that the stock market encourages. Shareholders usually want bigger dividends. Therefore, firms listed on the stock market can feel under pressure to increase short-term profits. This can lead to cost cutting which affects workers e. It has been argued that UK firms are more prone to short-termism because the stock market plays a bigger role in financing firms.

In Germany, firms are more likely to be financed by long-term loans from banks. Typically, banks are more interested in the long-term success of firms and are willing to encourage more investment, rather than short-term profit maximisation.

The fluctuations in the stock market intensely affect the economy of a country whenever the market is going bull or bear the economy of that particular country is affected and the value of its currency with respect to the forex is derived accordingly. Yeah offcourse its a strong relation between stock market and economy, its really affect the economy. By the way content is really good. The stock exchange and the economy can not be separated because they both influence each other.

Your email address will not be published.

Stock Performance Before, During & After Recessions

Leave this field empty. Facebook RSS Follow economicshelp Basket. Tejvan Pettinger August 2, stock market. Stock markets have predicted 10 out of the last 3 recessions. Economic effects of the stock market 1. Wealth effect The first impact is that people with shares will see a fall in their wealth.

Effect on pensions Anybody with a private pension or investment trust will be affected by the stock market, at least indirectly. Confidence Often share price movements are reflections of what is happening in the economy. Investment Falling share prices can hamper firms ability to raise finance on the stock market. Bond market A fall in the stock market makes other investments more attractive.

Euro fiscal crisis How does the stock market effect ordinary people? Related Essays on recessions Will a stock market crash cause a depression? September 26, at 5: October 25, at October 29, at 3: April 12, at 2: March 19, at 2: Leave a Reply Cancel reply Your email address will not be published.

Get Economics Help See all our Revision Guides. Economic Books - at Amazon. Economic History Causes of Wall Street Crash Causes of Great Depression UK economy in s UK Economy of s UK Economy - s Keynesian Economics Popular posts The problem of printing money The importance of economics Understanding exchange rates 10 reasons for studying economics Impact of immigration on UK economy.

Sections Microeconomics Macroeconomics Labour Markets. Ask an economic question You are welcome to ask any questions on Economics. I try and answer on this blog. About the Author Tejvan studied PPE at LMH, Oxford University and works as an economics teacher and writer. All rights reserved Contact Privacy Policy and Cookies Site by HappyKite.

This site uses cookies More info No problem.