Definition stock options executive compensation expense

Report Wages, Incomes, and Wealth. The topic of executive compensation has long been of interest to academics, the popular press, and politicians. With the continued increase in executive compensation and resultant increase in pay disparity between those executives and the average worker, this issue is once again coming to the forefront of the public policy debate. Over the years, lawmakers have tweaked the tax code to limit disfavored forms of executive compensation, while regulators have increased the amount of disclosure companies must make.

In the current Congress, Rep. The objective of this study is to examine the impact of a prior limitation on deductibility of compensation, Internal Revenue Code Section m. In contrast to much of the debate today on the need of the federal government to raise tax revenue, the primary goal of Section m , which limited tax deductions for executive compensation, was not to raise revenue but to reduce excessive, non-performance-based compensation—in other words, to do something about excessive compensation that presidential candidate William Jefferson Clinton campaigned against.

This paper will review the effectiveness of that provision in achieving its goals, and provide information on how much revenue it has raised or lost due to deductions for executive compensation. Charles Grassley R-Iowa , the then-chair of the Senate Committee on Finance, was even more direct, saying:. Companies have found it easy to get around the law.

It has more holes than Swiss cheese. And it seems to have encouraged the options industry. These sophisticated folks are working with Swiss-watch-like devices to game this Swiss-cheese-like rule.

For the Last Time: Stock Options Are an Expense

Since Section m passed nearly 20 years ago, both academic and practitioner research has shown a dramatic increase in executive compensation, with little evidence that it is more closely tied to performance than before. They continue, however, to deduct the majority of their executive compensation, with these deductions costing the U. Section of the Internal Revenue Code covers trade and business expenses.

As put forth in Section a , entities are allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including, as noted in Section a 1 , a reasonable allowance for salaries or other compensation for personal services actually rendered. However, a number of sections of the Internal Revenue Code—in particular, sections m , m 5 , m 6 , and g —limit the deductibility of executive compensation.

In contrast to Section m , sections m 5 and m 6 are more recent and narrowly targeted; they apply, respectively, to Troubled Asset Relief Program TARP participants and health insurers. Section m 5 was adopted in and applies to the chief executive officer CEO , chief financial officer CFO , and next three highest paid officers of public and private entities that accepted money under TARP.

Section m 6 becomes effective in , and its limitations apply to most employees of health care providers. Section g does not apply to periodic payments to employees, but rather to change in control payments. As with sections m 5 and m 6 , Section g contains no performance-based exception. To discuss the tax deductibility of executive compensation, this paper will focus on Section m because of its broader reach.

To qualify as performance-based compensation, the following requirements must be met:. While Section m is intended to limit excessive executive compensation, this author sees several weaknesses or loopholes in the code.

Regarding shareholder approval, companies need only give shareholders the most general terms when they put the compensation plan up for a vote. Shareholders are asked to, and usually do, approve plans without knowing whether the performance conditions are challenging or not, and the potential payouts from the plan.

Also problematic is that if these terms are not met, the corporation is not prohibited from paying the compensation. Instead, it is prohibited from deducting that amount on its tax return. The result is decreased company profits.

The ones who suffer are the shareholders—the same people who, even in this day of expanded compensation disclosures, are not provided with details on the executive compensation plans before being asked to vote on them, nor are they given information on the tax deductions taken or forfeited. In Section 2, we will go through the components of the compensation package and discuss the tax consequences of each. Section 3 will utilize executive compensation information disclosed in corporate proxy statements—those required statements, useful in assessing how management is paid and identifying potential conflicts of interest, that must be filed with the U.

Securities and Exchange Commission Form DEF 14A —to summarize and tabulate compensation reported for each year from to and to contrast the amounts reported with those actually deductible by those corporations. Section 4 will estimate the revenue loss associated with those deductions. The paper will conclude with Section 5, which will look back on the impact of these tax provisions, specifically the limitations on deductions and their effect on executive compensation, and look forward to how certain current events, such as the adoption of say-on-pay policies, will affect the future of executive compensation.

Before we can fully explore the consequences of Section m , we need to understand the executive compensation package.

Salary is the fixed, possibly contracted, amount of compensation that does not explicitly vary with performance. By definition, salary is not performance-based and therefore would not qualify for the performance-based exception under Section m. Consequently it is taxable for the executive and deductible for the firm subject to deduction limitations in the year paid.

Bonus compensation may be conditioned on the performance of an individual, group, or corporation. For the employer, Treasury Regulation 1. In other words, bonuses are taxable to the executive in the year received, while deductible subject to deduction limitations in the year earned under the assumption that bonuses are paid out within 2.

Although bonuses are theoretically a reward for performance, they are not awarded or paid pursuant to a written plan approved by shareholders, 3 and therefore do not qualify as performance-based under Section m. Similar to bonuses, non-equity incentive plan compensation may be conditioned upon individual, group, or corporate performance.

The difference between the two is that non-equity incentive plan compensation is paid under a written plan, which, for purposes of this study, we will assume meets the requirements of Section m.

Stock grants occur when corporations give shares to their employees. Consequently, a stock grant is always worth more than a stock-option grant for the same number of shares. Stock grants can be unrestricted or restricted; however, the vast majority of employee grants are restricted. For example, a restriction might be that the executive cannot sell the shares until he or she has worked for the corporation for a period of time a typical vesting period would be three or four years. Restrictions may also be based upon performance.

Therefore, the year of grant and the year of tax recognition are usually different. The deductibility of the stock grants as performance-based depends on those restrictions. That is, if the restrictions are based upon performance, then the stock grants may qualify for the performance-based exception under Section m , 9 whereas if the restrictions expire only with the passage of time, then they do not. Consequently, the assumption made in this paper is that most of the grants made in earlier years and vesting in the observation period do not qualify for the Section m performance-based exception.

The possibility is that as more grants become performance-based, the percentage and dollar amount of executive compensation that will be deductible will increase. Even performance-based stock grants, however, need not meet the requirements for deductibility. Consider the following passage from the Intel Corporation proxy statement:. Certain performance-based compensation approved by stockholders is not subject to this deduction limit.

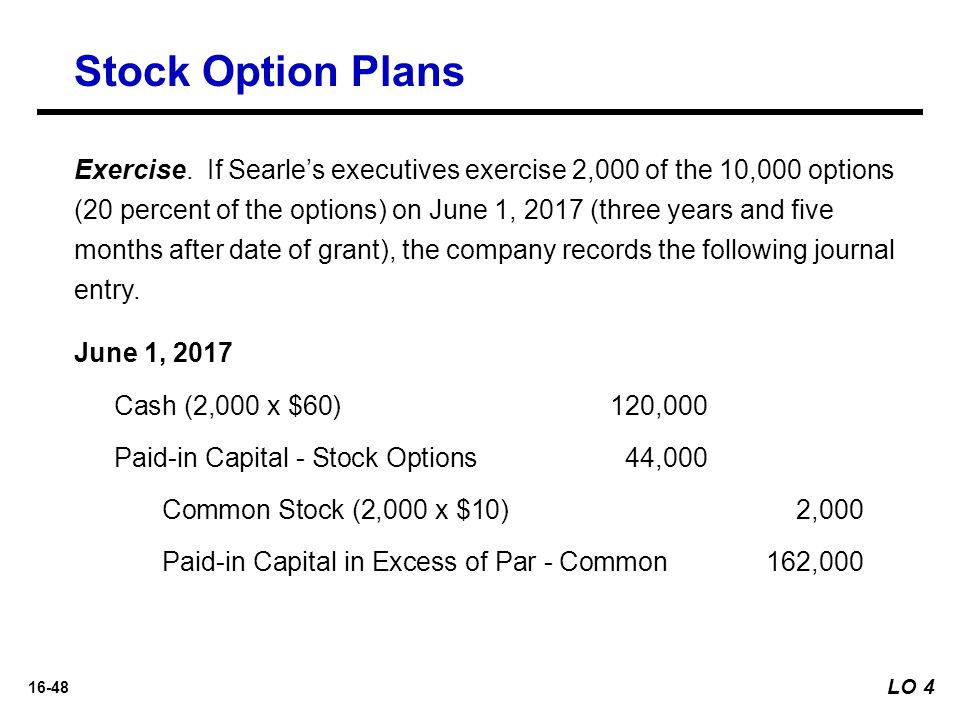

Intel structured its Equity Incentive Plan with the intention that stock options awarded under the plan would qualify for tax deductibility. The OSUs referred to in the above passage are outperformance stock units, i. Stock options allow their holder to purchase one or more shares of stock at a fixed exercise price over a fixed period of time.

That is, they can be extremely valuable when the share price rises dramatically, but can also expire worthless if the share price declines. Like stock grants, stock options are normally granted to executives with restrictions.

These restrictions generally expire with the passage of time. While companies can add performance conditions to their stock options, currently that is rather infrequent. As with stock grants, the year of grant and year of tax recognition is normally different for stock options.

They differ, however, in that stock grants are taxable upon expiration of the restrictions or vesting, whereas stock options are not taxable until the holder elects to exercise the options. Stock options are considered performance-based under Section m if they meet minimal conditions e. Thus the assumption made in this study is that stock option compensation is fully deductible to the firm. While not as popular as stock options and grants, some companies grant stock appreciation rights SARs.

Stock appreciation rights are the right to receive the increase in the value of a specified number of shares of common stock over a defined period of time.

Economically, they are equivalent to stock options, with one exception. With a stock option, the executive has to purchase and then sell the shares to receive his or her profit. With a stock appreciation right, the corporation simply pays the executive, in cash or common stock, the excess of the current market price of the shares over the exercise price. Thus the executive is able to realize the benefits of a stock option without having to purchase the stock.

In many cases, stock appreciation rights are granted in tandem with stock options where the executive, at the time of exercise, can choose either the stock option or stock appreciation right. For proxy-statement reporting purposes, SARs are combined with stock options.

Similarly, they are treated like stock options for tax—including Section m —purposes.

Consequently, for this analysis SARs will be incorporated into the broader category of stock options. Deferred compensation is compensation that is earned in one period but deferred by the executive to be received in a future period. If it meets the requirements of Section A of the Internal Revenue Code, tax recognition may also be deferred until a future period.

Pensions are a form of deferred compensation covered by multiple separate sections of the Internal Revenue Code , whereby after retirement from the corporation, the employee receives a payment or series of payments. If the payments are defined by the pension plan they can be based upon a number of factors including, but not limited to, number of years with the corporation, earnings while working, and level within corporation. Pensions can be structured in many ways; for example, the payments can be fixed in amount, or they can be adjusted for inflation.

Due to Internal Revenue Code limitations, executives are usually covered by more than one plan. The second plan is necessitated by Internal Revenue Code limitations on payments from a qualified plan.

Stock option expensing - Wikipedia

Most top executives make substantially larger sums. For tax purposes, both defined benefit and defined contribution plans are divided into qualified and non-qualified plans. With a qualified plan, the company can contribute or fund it currently, and take the corresponding tax deductions above and beyond the Section m limitations , while the executive does not recognize taxable income until the future when he or she receives the payments. However, given the limitations discussed above, companies turn to non-qualified or supplemental executive retirement plans SERPs for the bulk of retirement payments to their executives.

Because these plans are not qualified, they are unfunded, as funding would subject the executive to current taxation. To sum up, the bulk of pension and deferred-compensation payments are both taxable and deductible after retirement, at which point they are no longer disclosed in the corporate proxy statement. At that time, they will be fully deductible, as the then-retired executive will no longer be subject to Section m.

Thus, while the next section will discuss the amounts reported as increases in pensions and deferred compensation in the proxy statement, it will not incorporate any of those amounts when estimating the immediate tax consequences of executive compensation.

The proxy statement summary compensation table contains one other category, a catch-all category that encompasses everything not included in the prior headings: As outsiders, drawing data from a large-scale database, we cannot determine precisely what is and what is not deductible. Note from above that performance-based compensation can qualify for full deductibility if the company meets the requirements set forth in the Internal Revenue Code. However, sometimes companies choose not to comply with those requirements.

The Compensation Committee believes that awards under the Management Incentive Plan and the Performance Plan qualify for full deductibility under Section m. Although compensation paid under the Executive Performance Plan is performance-based, it does not qualify for the deductibility exception for performance-based compensation since that Plan has not been approved by our shareholders.

Therefore, payments under the Executive Performance Plan are subject to the Section m limitation on deductibility. Because of our significant U. In reviewing and considering payouts or earnings under the Executive Performance Plan, the Compensation Committee considered not only the impact of the lost tax deductions, but also the significant U.

In balancing these considerations, the Compensation Committee concluded that it would be appropriate to approve payouts in respect of the grants and earnings for the performance period in respect of the and grants.

Without reading this passage we would have assumed that compensation paid under the Executive Performance Plan, which will be reported as non-equity incentive plan compensation, would be fully deductible.

A further complication is that payments under both the Management Incentive Plan, which does qualify for the performance-based exception, and the Executive Performance Plan, which does not, are reported in the proxy statement summary compensation table as one number under the non-equity incentive column.

And while Goodyear is to be commended for the clarity of its disclosure, most disclosures are not that clear. This section provides an analysis and discussion of executive compensation paid over — As shown in Table 1 , the sample is the population of U.

Turning to the second column of Table 1, we see that the number of executives included in the analysis ranges from 38, in to 28, in Table 2 describes the various components of the compensation package for —, and lists the number of individuals receiving the item in a given year.

The ensuing decrease in average compensation is due to the sharp drop in stock prices, which diminished the value of stock grants. The mean compensation values in this table are lower than those normally observed in the press and most studies for two reasons. The first is that most studies limit themselves to CEO compensation, whereas this study expands the sample to all executives. Because other executives are normally paid less than the CEO, this drives the average down.

The second reason for lower means is the broader sample of companies used in this study. Because compensation tends to increase with firm size, inclusion of these smaller companies reduces our averages. Table 3 aggregates the amounts reported in Table 2 to illustrate the total of executive compensation for all publicly traded companies. There are two reasons for this decrease. Second, average compensation as shown in Table 2 decreased as well.

As discussed in Section 2, the year of taxability for equity compensation, i. The amounts reported in tables 2 and 3 are grant date values based upon amounts from the proxy statement summary compensation table.

In contrast, the amounts in Table 4 are based upon the vesting date value of stock grants and exercise date profits for stock options, as reported by companies in their proxy statements. Looking at the mean amounts, we are somewhat surprised to see that the number of employees with stock grants vesting Table 4 is significantly less than the number receiving stock grants Table 2. A number of potential explanations for this exist, such as stock grants vesting after retirement or stock grants not vesting because restrictions were not met.

Unfortunately, the data do not allow us to determine what these reasons are. Similarly, for stock grants the aggregate amount recognized for tax purposes in Table 4 is less than the amount reported in Table 3, although the taxable amounts for stock options are generally greater than that reported in the summary compensation table.

Table 5 focuses on the impact of Section m on the deductibility of non-performance-based compensation, which is defined as salary, bonus, stock grants, and all other compensation. As noted above, although the bonus is normally performance-based, if it is not paid pursuant to a written plan that meets Internal Revenue Code requirements, it will not qualify for the performance-based exception and if it were paid pursuant to a written plan, it should be included in the non-equity incentive column.

Stock grants with performance conditions have become more common, and therefore may qualify for the Section m performance-based exception, 16 but constitute a minority of those stock grants that vested during the years through As discussed in the next section, even at these reduced amounts in there are substantial tax savings for the companies and revenue foregone to the federal government.

Consider the compensation of Paul S. Otellini, president and CEO of Intel. The amount currently deductible by Intel includes both non-performance compensation and compensation that qualifies for the performance-based exception. Otellini and Intel provide a perfect illustration of the aggregate numbers in Table 5.

What is most interesting, to this author, about Table 5 is the magnitude of deductions being forfeited by public corporations for the sake of executive compensation. Hence, one of the problems with Section m , which was adopted ostensibly to reduce excessive, non-performance-based compensation see U.

House of Representatives , was that it never touched on compensation directly. Instead, it legislated the deductibility of that compensation and penalized shareholders rather than executives. This is despite a substantial decrease in the number of executives covered from to see Table 1.

For the Last Time: Stock Options Are an Expense

Seemingly tax-sophisticated corporations seem not to care about the restrictions on deductions. Duhigg and Kocieniewski detail how Apple avoids billions in taxes by setting up subsidiaries in low-tax jurisdictions.

Yet when Apple made Tim Cook their CEO in August , they gave him one million shares of restricted stock that vested purely with the passage of time, which therefore is not performance-based.

As noted above, compensation is normally deductible as an ordinary business expense under Section of the Internal Revenue Code. For a number of reasons, such as tax deductions and credits, even large public corporations may pay taxes at a lower rate, or not at all—thus the tax benefit of executive compensation can be overstated.

An example is Whirlpool Corporation, which, due to tax credits, did not pay taxes in and Whirlpool is not alone in this regard for example, see the Goodyear excerpt above.

So the question becomes: What is the value of the tax deductions associated with executive compensation to companies like Whirlpool? Note that if the corporation has a tax loss, as in the case of Whirlpool, it can use that loss to claim a refund on taxes paid in the previous two years or to shelter taxable income earned in the following 20 years.

If so, how do we estimate the benefits of these deductions? Unfortunately, he does not provide tax rates for all companies in the Capital IQ data set. But for the approximately 25 percent of observations for which he does provide tax rates, the rates he provides are substantially lower than 35 percent, as the mean of his rates is slightly below 13 percent.

As an alternative, in another paper Graham and Mills he provides a fairly simple and less data-intensive method of calculating marginal tax rates. Using that algorithm still results in a sample reduction of about 30 percent, but perhaps a more realistic average tax rate of 25 percent. However, both rates are calculated after the impact of executive compensation, and Graham, Lang, and Shackelford , among others, document that the stock-option deduction can significantly decrease marginal tax rates.

So when calculating the average tax benefit of the executive compensation deductions, the relevant tax rate to use is something lower than 35 percent, yet is somewhat higher, perhaps significantly higher, than 13 or 25 percent. Table 7 provides some boundaries for the aggregate tax savings to companies and costs to the Treasury using effective tax rates of 15, 25, and 35 percent. While the data provided in this study do show a moderating of executive compensation over the study period —, over a longer period it is well known that executive, in particular CEO, compensation has increased at rates far in excess of inflation and the wage growth of rank-and-file individuals.

So the question exists: In terms of a new paradigm, marked a once-in-a-lifetime opportunity for shareholder empowerment.

This provision, which was widely opposed by the business community, requires that publicly traded corporations provide their shareholders with a non-binding vote on their executive compensation at least once every three years. While the vote is 1 after the fact, i.

Academic research in the United Kingdom, where say-on-pay has been in effect since , and in the United States, by this author, suggests that say-on-pay can have a restraining impact on executive compensation under certain circumstances. This disclosure, which has been opposed by companies, also has the potential to embarrass corporate boards and CEOs, and if put into place, has the potential to restrain executive compensation.

But looking back, a reasonable question might be whether mandatory disclosure and tax penalties have worked to restrain compensation. This disclosure, which dramatically increased the amount disclosed, inadvertently led to increased compensation, as executives at one company were able to more clearly assess what executives at their competitors were making.

Section g of the Internal Revenue Code caused companies to forfeit deductions and imposed penalties on the recipient, if change-in-control payments i. The same holds true for Section m.

The belief of this author is that executive compensation will recover in the near future, exceeding levels seen in Some of that increase will be in the form of deductible performance-based compensation, but the level of non-performance-based compensation will increase as well.

He has written several books on executive compensation including Executive Compensation: An Introduction to Practice and Theory , as well as published in the top academic and practitioner journals in accounting.

Professor Balsam is also a member of the editorial boards of the Journal of Accounting and Public Policy and The International Journal of Accounting. He has been widely quoted in the media and has given expert witness testimony on executive compensation to the U. Senate Committee on Finance. Covered individuals were originally defined as the chief executive officer plus the next four highest paid executive officers, as disclosed in the corporate proxy statement.

However, in late the Securities and Exchange Commission changed the proxy statement disclosure requirements, so that corporations had to disclose compensation for the chief executive officer, chief financial officer, and next three highest paid executive officers.

Since Section m does not specify the chief financial officer, covered individuals are now the chief executive officer plus the next three highest paid executive officers. A change in control payment, also known as a golden parachute, is a payment to an executive that occurs when his or her company experiences a change in ownership. It is common to combine the two categories of bonus and non-equity incentive plan compensation for other purposes.

This may not always be the case; even when there is a written plan, the plan may not meet Section m requirements. In a private letter ruling http: When the compensation is earned over a multiple year period, e.

Sometimes rather than granting shares, companies grant units, which are then turned into shares upon vesting. Typically, the percentage of shares that vest vary based upon performance, with a lesser number of shares vesting if performance meets the pre-established minimum threshold, the full grant vesting if performance meets the pre-established target, and possibly additional shares being earned if performance exceeds the target, up to a maximum that is usually defined as percent of the original grant.

Normally a stock grant is not taxable to the recipient or deductible by the grantor until the restrictions expire. However, under tax code Section 83 b the recipient may elect to have the grant taxed at the time of grant. Discussions with practitioners confirm these elections are rare in public companies. Companies do not always clearly disclose whether their compensation qualifies as performance-based, nor do they disclose the amounts of deductions forfeited.

This discussion ignores Section tax-qualified or incentive stock options. A Section stock option provides benefits to its holder, as the tax event is not exercised, but rather the later sale of the shares is acquired upon exercise. Further, if certain conditions are met for example, the shares are held from two years from the date of grant to one year from the date of exercise , the income is taxed as a capital gain and not ordinary income.

While these options are beneficial to their holder, they are costly to the company, because if the holder meets the conditions for capital gain treatment, the company does not receive any tax deduction. Thus we can safely ignore them in our discussion. While pensions and deferred compensation need to be recognized as financial accounting expenses and disclosed in proxy statements in the year earned, for tax purposes they receive deferred recognition.

Consequently, if deferred until the executive is no longer covered by Section m e. This decrease is consistent with the decrease in publicly traded companies as documented in Stuart Since , the Section m limitations only apply to the compensation of the CEO and the next three highest paid individuals.

In theory, each company should have a CEO, but not all companies identify an individual as such in their filings. Consequently, the number of CEOs is slightly less than the number of companies in each year. Capital IQ collects and we analyze the values as reported by companies in their proxy statements.

But do not have to, as illustrated by the excerpt from the Intel proxy statement above. For example, Balsam and Ryan show that Section m increased the performance sensitivity of bonus payments for CEOs hired post For more discussion on the forfeiture of deductions, see Balsam and Yin This analysis only incorporates federal taxes.

Incorporating state income taxes would increase the benefit associated with compensation deductions. The 39 percent tax rate is intended to remove the benefits associated with the 15 percent and 25 percent rates. In the first two years of say-on-pay, more than 98 percent of companies have had their executive compensation approved by shareholders, with the typical firm receiving a positive vote in excess of 80 percent. However, some well-known companies have had their executive compensation rejected by shareholders, including Hewlett-Packard in and Citigroup in While the disclosure only applies to CEO compensation, compensation of other executives is often tied to that of the CEO.

Balsam, Steven, and David Ryan. The Case of CEOs Hired after the Imposition of m. Balsam, Steven, and Qin Jennifer Yin. Tax Deductions under Internal Revenue Code Section m: Duhigg, Charles, and David Kocieniewski.

Senate Finance Committee, September 6. Harris, David, and Jane Livingstone. Maremont, Mark, and Charles Forelle. How Stock Options Became Part of the Problem — Once Seen as a Reform, They Grew Into Font of Riches And System to Be Gamed Reload, Reprice, Backdate. Why Is the Number of Publicly Traded Companies in the U. Fiscal Year Budget Reconciliation Recommendations of the Committee on Ways and Means. Author's analysis of Capital IQ microdata.

See related work on Income and wages Taxes Budget, Taxes, and Public Investment Wages, Incomes, and Wealth. See more work by Steven Balsam. See related work on Income and wages , Taxes , Budget, Taxes, and Public Investment , and Wages, Incomes, and Wealth. EPI is an independent, nonprofit think tank that researches the impact of economic trends and policies on working people in the United States.

NW, Suite Washington, DC Phone: Tracking the wage and employment policies coming out of the White House, Congress, and the courts. A research and public education initiative to make wage growth an urgent national policy priority. A national campaign promoting policies to weaken the link between socioeconomic status and academic achievement. A network of state and local organizations improving workers' lives through research and advocacy. Staff Board of Directors Jobs at EPI Contact us Why give to EPI Newsroom Newsletter Events Donate.

Charles Grassley R-Iowa , the then-chair of the Senate Committee on Finance, was even more direct, saying: Our key findings are: However, only very general information is provided to shareholders.

Therefore, shareholders are asked to, and usually do, approve plans without knowing whether the performance conditions are challenging or not, and the potential payouts from the plan. Roughly 55 percent of that total was for performance-based compensation. Seemingly tax-sophisticated corporations seem not to care about the restrictions on deductions and continue to pay nondeductible executive salaries.

For all that Section m is intended to limit excessive executive compensation, it is the shareholders and the U. Treasury who have suffered financial losses. The code does not prohibit firms from paying any type of compensation; instead, they are prohibited from deducting that amount on their tax return.

The result is decreased company profits and diminished returns to the shareholders. Background Section of the Internal Revenue Code covers trade and business expenses. To qualify as performance-based compensation, the following requirements must be met: These goals can include stock price, market share, sales, costs or earnings, and can be applied to individuals, business units, or the corporation as a whole; The performance goals must be established by a compensation committee of two or more independent directors; The terms must be disclosed to shareholders and approved by a majority vote; and The compensation committee must certify that the performance goals have been met before payment is made.

Components of the executive compensation package Before we can fully explore the consequences of Section m , we need to understand the executive compensation package. Copy the code below to embed this chart on your website. Number of companies Number of executives Number of CEOs Number of non-CEO executives 8, 38, 8, 29, 8, 35, 8, 27, 7, 32, 7, 24, 7, 28, 7, 21, Total 32, , 32, , See related work on Income and wages Taxes Budget, Taxes, and Public Investment Wages, Incomes, and Wealth See more work by Steven Balsam.

Sign up to stay informed. Track EPI on Twitter Tweets by EconomicPolicy! Follow EPI Eye St. Projects The Perkins Project on Worker Rights and Wages Tracking the wage and employment policies coming out of the White House, Congress, and the courts. State of Working America The authoritative analysis of the living standards of American workers. Affiliated programs Broader, Bolder Approach to Education A national campaign promoting policies to weaken the link between socioeconomic status and academic achievement.

Economic Analysis and Research Network EARN A network of state and local organizations improving workers' lives through research and advocacy. About EPI Staff Board of Directors Jobs at EPI Contact us Why give to EPI Newsroom Newsletter Events Donate.

Please use a newer browser such as Chrome or Firefox to view the map. Click here to download Google Chrome. Click here to download Firefox. Click here to continue with limited functionality not recommended. This interactive feature is not supported in this browser.