Vanguard institutional total stock market index

A brief product description that includes information on performance, cost, industry weightings, top holdings, investment approach, and portfolio attributes. The following additional terms and conditions apply to the publication on this Site of any Vanguard fund's portfolio holdings as described above:.

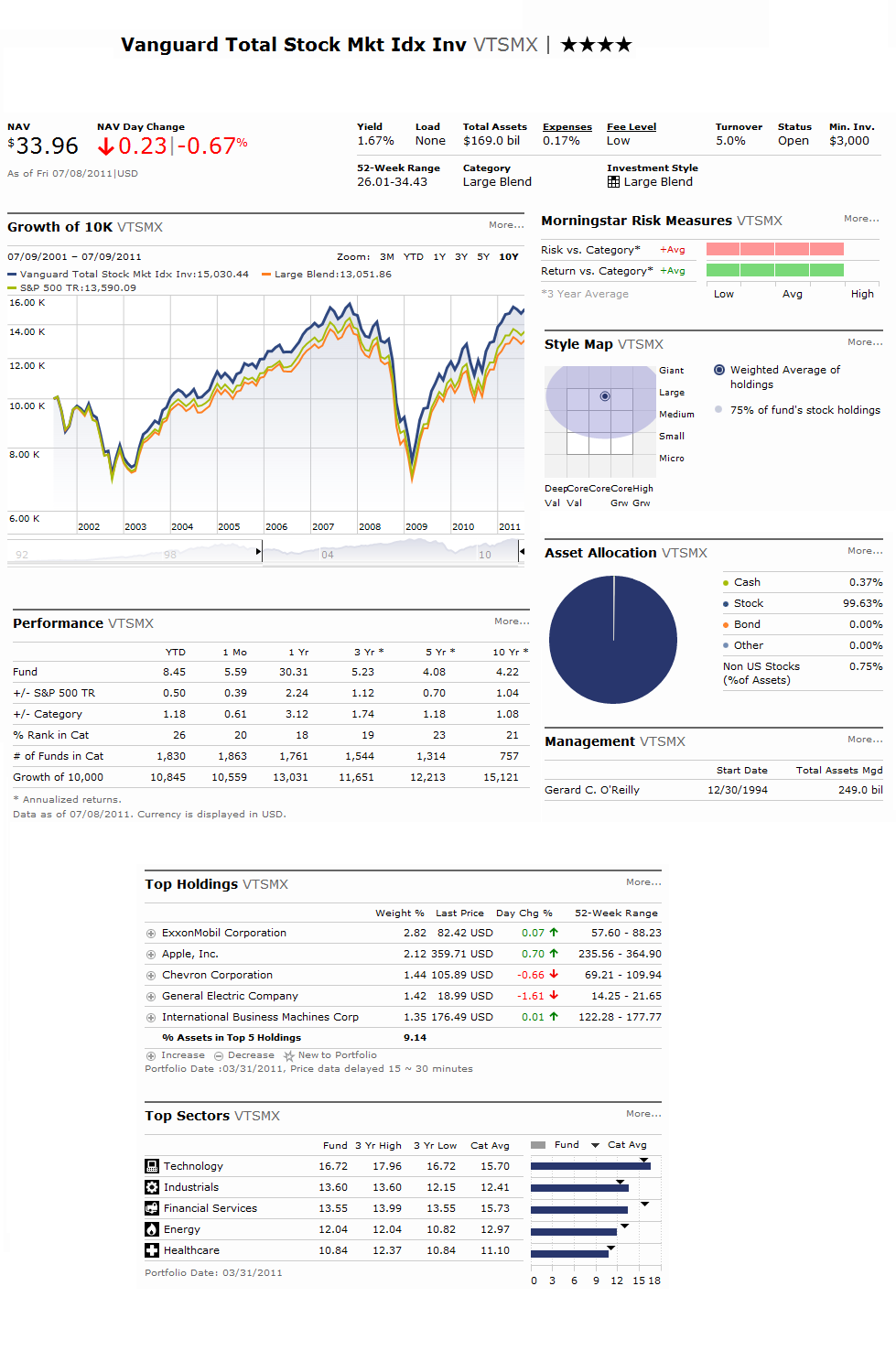

In the stylebox, it is shown as a dot within the shaded oval. In the stylebox, the expected range of frequently owned categories is represented by a shaded oval.

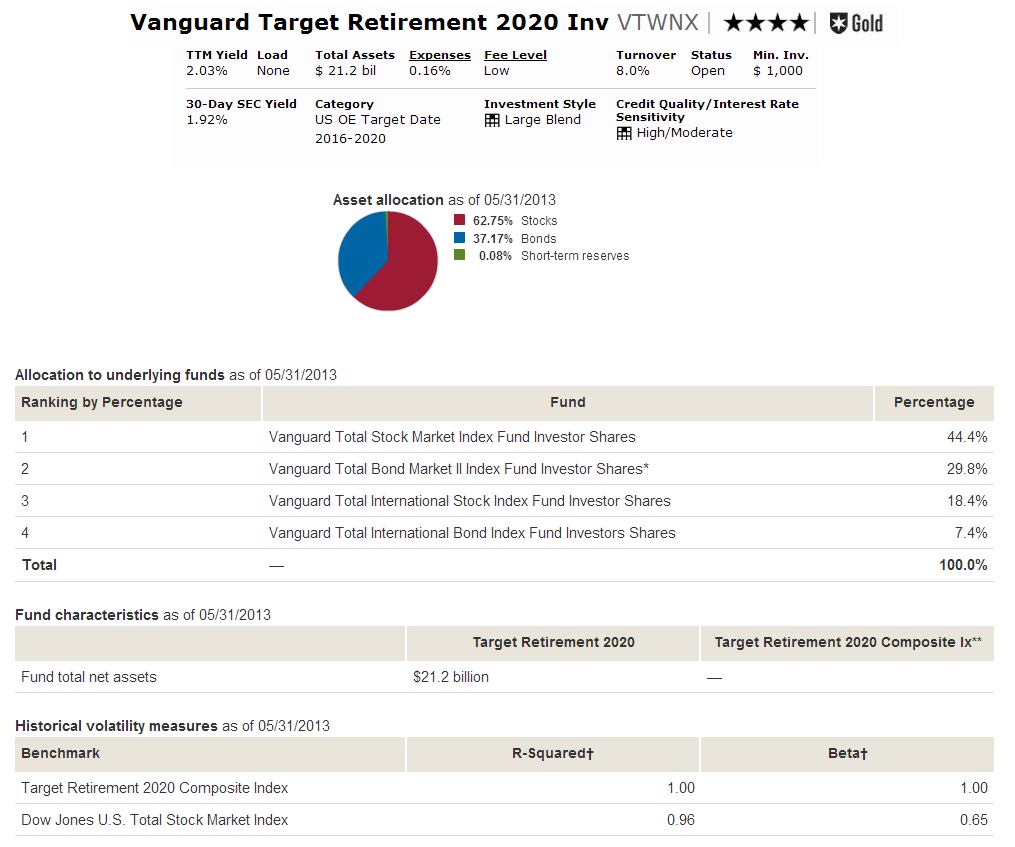

Styleboxes for bond funds uses duration rather than average weighted maturity. Duration is a more accurate measure of interest rate sensitivity because it takes into consideration all mortgage prepayments, puts, and adjustable coupons.

A fund may offer multiple share classes. The objectives, strategies, and policies for all share classes of a fund are identical. However, expense ratios vary by share class, reflecting the differing costs of providing services to the holders of each share class.

VITNX Fund - Vanguard Institutional Total Stock Market Index Fund;Institutional Overview - MarketWatch

Traditional shares for individual investors that typically feature low minimum initial investments. A lower-cost share class generally available without a minimum initial investment requirement to institutional investors and financial intermediary clients. Vanguard created Admiral Shares to recognize and encourage the cost savings stemming from large, long-standing investment accounts and to pass these savings on to the shareholders who generate them.

Shares generally available to large institutional investors. Exchange-traded shares of certain Vanguard index funds, ETF Shares combine the benefits of indexing, such as low costs and broad market diversification, with the trading and pricing flexibility of individual stocks.

Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. This Vanguard Trust currently invests solely in a Vanguard mutual fund.

Portfolio information displayed Sector weightings, Top 10 holdings, Characteristics, Composition, and Fundamentals represents the mutual fund's holdings. OPTIONS as of —.

Pricing flexibility is available. For information about fees, contact your Vanguard representative, or call For information about minimums, contact your Vanguard representative, or call A fee charged by some mutual funds when an investor buys shares.

This fee is not a sales charge or load because it is paid directly to the fund to offset the costs of trading certain securities. A fee charged by some mutual funds when an investor sells shares. A redemption fee differs from a back-end load because the money is paid back into the fund. Many funds charge redemption fees only when shares are bought and then sold within a specific period of time, generally in an effort to discourage market-timing and short-term trading.

Some brokers also charge their clients redemption fees for the sale of securities. Stock Index portfolio with exposure to large-, mid-, and small-capitalization stocks diversified across investment styles.

Central tendency Expected range. Fee adjusted for mutual funds where applicable. This fund does not have a long enough history to provide annual performance data.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited.

VITPX Fund - Vanguard Institutional Total Stock Market Index Fund;Inst Plus Overview - MarketWatch

Sector categories are based on the Industry Classification Benchmark system. Portfolio holdings may exclude any temporary cash investments and equity index products. Risk and volatility are based on the share class with the earliest inception date.

Risk measures are calculated from trailing month fund returns relative to the associated benchmarks. Risk and volatility information is not available for a fund less than 3 years old. An investment in the trust portfolio could lose money over short or even long periods. The chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising stock prices and periods of falling stock prices. The chance that the securities selected for the fund, in the aggregate, will not provide investment performance matching that of the index.

Index sampling risk for the fund should be low. Vanguard Institutional Total Stock Market Index Trust is not a mutual fund. It is a collective trust available only to tax-qualified plans and their eligible participants. Investment objectives, risks, charges, expenses, and other important information should be considered carefully before investing.

The collective trust is managed by Vanguard Fiduciary Trust Company, a wholly owned subsidiary of The Vanguard Group, Inc. Risk and volatility details. Comparison of index methodologies. Vanguard reports April expense ratio changes. Vanguard reports March expense ratio changes. Your input was invalid.

Vanguard portfolio holdings disclaimer. Vanguard may publish on this Site, in the fund's holdings on the webpages, the ten largest stock portfolio holdings of a Vanguard fund, and the percentage of the fund's total assets that each of these holdings represents as of the most recent calendar-quarter-end, 15 calendar days after the end of the calendar quarter, except for Vanguard index funds 15 calendar days after the end of the month.

Vanguard may also publish on this Site, in the fund's holdings on the webpages, the ten largest stock portfolio holdings of a Vanguard fund, and the aggregate percentage that these holdings represent of the fund's total net assets and equities, as of the most recent month-end, ten business days after the end of the month.

Vanguard may publish on this Site, in the fund's holdings on the webpages, a detailed list of the securities aggregated by issuer for money market funds held in a Vanguard fund portfolio holdings as of the most recent calendar-quarter-end, 30 days after the end of the calendar quarter, except for Vanguard Market Neutral Fund 60 calendar days after the end of the calendar quarter , Vanguard index funds 15 calendar days after the end of the month , and Vanguard Money Market Funds within five [5 business days after the last business day of the preceding month.

Except with respect to Vanguard Money Market Funds, Vanguard may exclude any portion of these portfolio holdings from publication on this Site when deemed in the best interest of the fund. Except with respect to Vanguard Money Market Funds, the portfolio holdings are provided on a delayed basis and will not necessarily represent all of the actual investments held by the relevant Vanguard fund. The following additional terms and conditions apply to the publication on this Site of any Vanguard fund's portfolio holdings as described above: By accessing the portfolio holdings, you agree not to reproduce, distribute, or disseminate the portfolio holdings, in whole or in part, in any form without prior written permission of Vanguard.

Except with respect to Vanguard Money Market Funds, the portfolio holdings are provided on an "as is" basis, and Vanguard makes no express or implied warranties or representations with respect to the accuracy, completeness, reliability, or fitness of the portfolio holdings or any financial results you may achieve from their use.

In no event shall Vanguard or its affiliates have any liability relating to the use of the portfolio holdings.

Two important things about a fund are shown in its stylebox: Fund share classes A fund may offer multiple share classes. Here are some of the key distinctions: Investor Shares Traditional shares for individual investors that typically feature low minimum initial investments.

Institutional Select Shares Shares generally available to large institutional investors. ETF Shares Exchange-traded shares of certain Vanguard index funds, ETF Shares combine the benefits of indexing, such as low costs and broad market diversification, with the trading and pricing flexibility of individual stocks.

All investing is subject to risk, including the possible loss of the money you invest. OPTIONS as of — Options Expense ratio Minimum Trust Note Pricing flexibility is available.

STYLEBOX Stock Index portfolio with exposure to large-, mid-, and small-capitalization stocks diversified across investment styles. Seeks to track the performance of the CRSP US Total Market Index.

VITSX - Vanguard Total Stock Market Index Fund Institutional Shares Mutual Fund Quote - yfyrurusus.web.fc2.com

Large, mid-, and small-cap equity diversified across growth and value styles. Expected to achieve its investment objective by investing in Institutional Select shares of the Vanguard Total Stock Market Index Fund. Portfolio remains fully invested. Low expenses minimize net tracking error.

TOOLS Custom date reports. Note Pricing flexibility is available. Note For information about minimums, contact your Vanguard representative, or call