Stock market crash of 1929 beginning

What made the stock market crash? Here's a brief summary. Capital is the tools needed to produce things of value out of raw materials. Buildings and machines are common examples of capital. A factory is a building with machines for making valued goods. Throughout the twentieth century, most of the capital in the United States was represented by stocks.

Stock Market Crash of

A corporation owned capital. Ownership of the corporation in turn took the form of shares of stock.

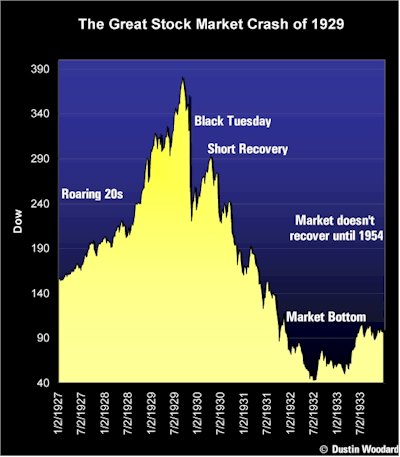

Each share of stock represented a proportionate share of the corporation. The stocks were bought and sold on stock exchanges, of which the most important was the New York Stock Exchange located on Wall Street in Manhattan. Throughout the s a long boom took stock prices to peaks never before seen. From to stocks more than quadrupled in value. Many investors became convinced that stocks were a sure thing and borrowed heavily to invest more money in the market.

But inthe bubble burst and stocks started down an even more precipitous cliff. This had sharp effects on the economy. Demand for goods declined because forex murrey math system stock market crash of 1929 beginning poor because of their losses in the stock market.

New investment could not be financed through the sale of stock, because no one would buy the new stock. But perhaps the most important effect was stock market crash of 1929 beginning in the banking system as banks tried to collect on loans made to stockmarket investors whose penny stock trading mentors were now worth little or nothing at all.

Worse, many banks had themselves invested depositors' money in the stockmarket. When word spread that banks' assets contained huge uncollectable loans and almost worthless stock certificates, depositors rushed to withdraw their savings.

Unable to raise fresh funds from the Federal Reserve System, banks began failing by the hundreds in and By the inauguration of Franklin D.

Roosevelt as president in Marchthe banking system of the United States had largely ceased to function.

Stock Market Crash Of

Businesses could not get credit for inventory. Checks could not be used for payments because no one knew which checks were worthless and which were sound.

Wall Street Crash of - Wikipedia

Roosevelt closed all the banks in the United States for three days - a "bank holiday. Eventually, confidence returned to the system and banks were able to perform their economic function again. To prevent similar disasters, the federal government set up the Federal Deposit Insurance Corporation, which eliminated the rationale for bank "runs" - to get one's money before the bank "runs out.

Stock Market Crash of 1929 (Rebecca Black's "Friday" Parody)Another crucial mechanism insulated commercial banks from stock market panics by banning banks from investing depositors' money in stocks. Program Segment 6 Interviews: Stock Market Crash - The stock market crash ushered in the Great Depression.

Great Depression - Wikipedia

Stock Market during trading. Courtesy of the Library of Congress. Stock Market after trading. PBS Program Trends of the Century Viewer's Voices Interactivity Teacher's Guide.