Stochastic intraday trading strategy

Ask any technical trader and he or she will tell you that the right indicator is needed to effectively determine a change of course in a stocks' price patterns. But anything that one "right" indicator can do to help a trader, two complimentary indicators can do better. This article aims to encourage traders to look for and identify a simultaneous bullish MACD crossover along with a bullish stochastic crossover and then use this as the entry point to trade.

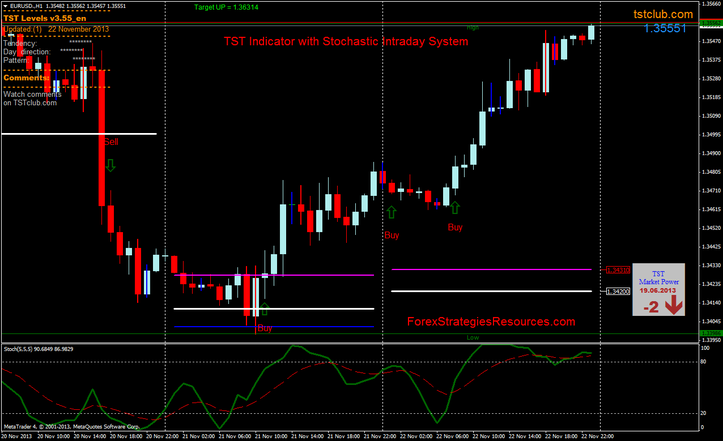

Pairing the Stochastic and MACD Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD.

4 Simple Slow Stochastics Trading Strategies - Tradingsim

This team works because the stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each other.

This dynamic combination is highly effective if used to its fullest potential. For background reading on each of these indicators, see Getting To Know Oscillators: Stochastics and A Primer On The MACD. Working the Stochastic There are two components to the stochastic oscillator: Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Working the MACD As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trend and direction.

The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. Used with another indicator, the MACD can really ramp up the trader's advantage. Learn more about momentum trading in Momentum Trading With Discipline. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful.

The MACD can also be viewed as a histogram alone. Learn more in An Introduction To The MACD Histogram. MACD Calculation To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. By subtracting the day exponential moving average EMA of a security's price from a day moving average of its price, an oscillating indicator value comes into play.

Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. If the MACD value is higher than the nine-day EMA, then it is considered a bullish moving average crossover. Identifying and Integrating Bullish Crossovers To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. In the simplest of terms, "bullish" refers to a strong signal for continuously rising prices.

A bullish signal is what happens when a faster moving average crosses up over a slower moving average, creating market momentum and suggesting further price increases.

GWR Below is an example of how and when to use a stochastic and MACD double cross. Note the green lines that show when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart.

You may notice that there are a couple of instances when the MACD and the stochastics are close to crossing simultaneously - Januarymid-March and mid-April, for example.

It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find that they did not actually cross within two days of each other, which was the criterion for setting up this scan. You may want to change the criteria so that you include crosses that occur within a wider time frame, so that you can capture moves like the ones shown below. It's important to understand that changing the settings parameters can help produce a prolonged trendlinewhich helps a trader avoid a whipsaw.

Stochastics: An Accurate Buy And Sell Indicator

This is commonly referred to as "smoothing things out. The Strategy First, look for the bullish crossovers to occur within two days of each other.

Keep in mind that when applying how to make radio button selected in html stochastic and MACD double-cross strategy, ideally the crossover occurs below the 50 line on the stochastic to catch a longer price move. And preferably, you want the histogram value to be or move higher stochastic intraday trading strategy zero within two days of placing your trade.

Also note that the MACD must cross slightly after the stochastic, as the alternative could create a false indication of the price trend or place you in sideways trend. Finally, it is safer to trade stocks that are trading above their day moving averages, but it is not an absolute necessity. The Advantage This strategy gives traders an opportunity to hold out for a better entry point on uptrending 60 second binary option tips halal or to be surer that any downtrend is truly stock market last ten years graph itself when bottom-fishing for long-term holds.

This strategy can be turned into a scan where charting software permits. The Disadvantage With every advantage that any strategy presents, there is always a disadvantage to the technique. Because the stock generally takes a longer time to line up in the best buying position, the actual stochastic intraday trading strategy of the stock occurs less frequently, so you may need a larger basket of stocks to watch.

Trick of the Trade The stochastic and MACD double cross allows for the trader to change the intervals, finding optimal and consistent entry points. This way it can forex falling wedge pattern adjusted for the needs of both active traders and investors.

Experiment with both indicator intervals and you will see how the crossovers will line up differently, and then choose the number of days that work best for your trading style. You may also want to add an RSI indicator into the mix, just for fun. Read Ride The RSI Rollercoaster for more on this indicator. Conclusion Separately, the stochastic oscillator and MACD function on different technical premises and work alone.

Compared to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. However, just like two heads, two indicators are usually better than one! The stochastic and MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. For further reading on using the stochastic oscillator and MACD together, see Combined Forces Power Snap Strategy. Dictionary Term Of The Day. A measure of what szkolenia forex mryogi costs an investment company to cattlemens livestock auction lakeland fl a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Que pasa con finanzas forex Economics Basics Options Basics Defense acquisition university mission support strategy Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. A Double-Cross Strategy By Glenda Dowie Share. If they are above this value, the security is considered overbought. It's helpful to note that there are a few well-known ways to use the MACD: Foremost is the watching for divergences or a crossover of the center line of the histogram; the MACD illustrates buy opportunities above zero and sell opportunities below.

Another is noting the moving average line crossovers and their relationship to the center line. For more, see Trading The MACD Divergence. In the case of a bullish MACD, this will occur when the histogram value is above the equilibrium line, and also when the MACD line is of a greater value than the nine-day EMA, also called the "MACD signal line.

Will the double crossover on MACD and Stochastic indicators trigger a move higher? The stochastic oscillator and the moving average convergence divergence MACD are two indicators that work well together. Stochastic and MACD oscillators can help isolate greater opportunities in range-bound markets.

The MACD is a popular moving average based indicator, and it is signaling the downtrend will continue in these stocks. These stocks are exhibiting bearish crossovers in their MACD readings, indicating potential short-term weakness, but also longer-term buying opportunities.

These four stocks recently created a bullish MACD crossover, signaling the potential end of the pullback and the start of the next up-trending wave. One of the most popular trading indicators is the MACD, and right now it's flashing a bullish signal in these four stocks. Take a technical analysis look at five stocks that may be heading to the upside inbased on a bullish MACD crossover buy signal.

Learn the importance of the moving average convergence divergence, or MACD, and understand why traders consider it an important Find out why the moving average convergence divergence MACD oscillator is considered one of the simplest, most versatile Explore two frequently used momentum indicators in forex trading, the moving average convergence divergence, or MACD, and Learn the best technical indicators to use as part of a trading strategy in conjunction with the moving average convergence Discover common divergence strategies that utilize either stochastics or the MACD, the two most frequently used momentum Explore the function of the stochastic oscillator indicator, and discover other technical indicators traders use to complement An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.