Rotational trading strategies

Frank Hassler at Engineering Returns blog wrote an excellent article Rotational Trading: The article presents four methods to reduce trades:. I want show how to implement these ideas using the backtesting library in the Systematic Investor Toolbox.

Rotational Trading Strategies: borrowing ideas from Engineering Returns | Systematic Investor

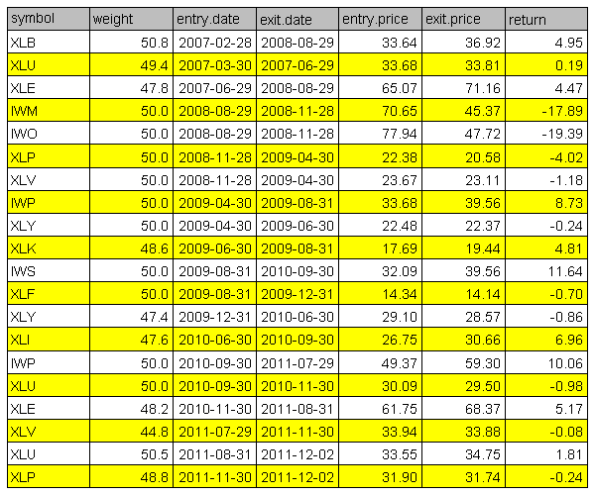

I will use the 21 ETFs from the ETF Sector Strategy post as the investment universe. Following code loads historical prices from Yahoo Fiance and compares performance of the daily versus weekly rebalancing using the backtesting library in the Systematic Investor Toolbox:. The number of trades falls down from to as we switch from daily to weekly rebalancing.

The additional bonus is the better returns for the weekly rebalancing.

The number of trades falls down from to 95 to 52 as we hold on to our selection for longer periods. The number of trades falls down as we increase the length of period used in averaging. There is no big difference in using simple moving average SMA versus exponential smoothing average EMA. The number of trades falls down from to 28 and performance CAGR goes up from 2.

yfyrurusus.web.fc2.com - Tools to Backtest Rotation Momentum StrategiesOne solution is discussed in the Avoiding severe draw downs post. To view the complete source code for this example, please have a look at the bt. Staying on the subject of selecting top performing assets.

I think it might be interesting to see an example of switching between different strategies based on their performance. We test a trend following strategy and a mean reversion strategy and we switch between the two strategies based on their performances over the last X days. You are commenting using your WordPress. You are commenting using your Twitter account.

SectorSurfer: Sector Rotation Investment Strategies

You are commenting using your Facebook account. Notify me of new comments via email. Systematic Investor Systematic Investor Blog. Home About Systematic Investor Toolbox Research Shiny.

Faber's Sector Rotation Trading Strategy [ChartSchool]

The article presents four methods to reduce trades: Smooth the rank over the last couple of bars. Following code loads historical prices from Yahoo Fiance and compares performance of the daily versus weekly rebalancing using the backtesting library in the Systematic Investor Toolbox: Backtesting , Portfolio Construction , R , Strategy , Trading Strategies.

Comments 1 Trackbacks 0 Leave a comment Trackback.

Dear, very interesting post. Leave a Reply Cancel reply Enter your comment here Fill in your details below or click an icon to log in: Email required Address never made public.

RSS feed Google Youdao Xian Guo Zhua Xia My Yahoo! Archives February August May April March February December November October August July June May April March February January December November October September August July June May April March February January December November October Categories Asset Allocation Backtesting Cluster Factor Model Factors Portfolio Construction R Risk Measures Shiny Strategy Trading Strategies Uncategorized.

Meta Register Log in Entries RSS Comments RSS WordPress. Blogroll CSS Analytics Engineering Returns Portfolio Probe Quantivity R-bloggers The Whole Street Timely Portfolio.

Top Blog at WordPress.