P2p lending vs stock market

The most considerable deciding factor when looking at investments is risk. Much of investment discussion revolves around risk management.

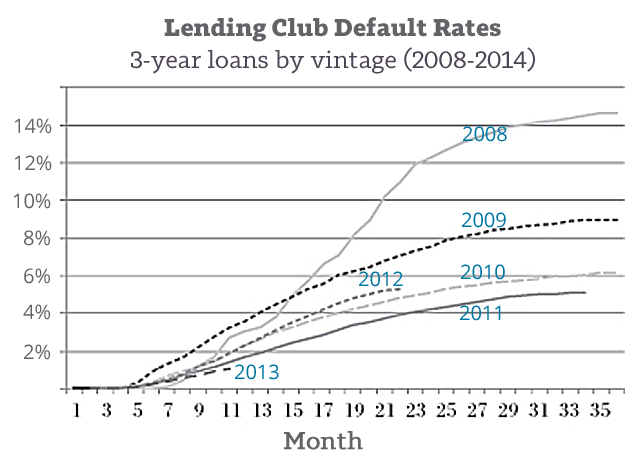

Peer-to-peer lending - the pros and consDefaults are unpredictable, but past performance can lend some insight into the future. For instance, if defaults are high in a city it would make sense to either increase interest rates for that city, or to avoid it all together.

Businesses calculate risk all the time based on past experience, P2P lending should be no different. Many times people who own stocks that have lost money will simply sell to avoid further loss, or when they feel a stock will never rebound.

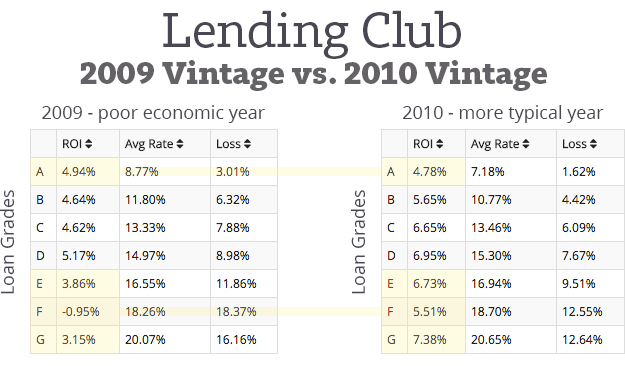

There are ranges of risk for both investment types that should appeal to all. Likewise highly risky stocks like experimental drug companies may be looked at like C — G HR grade loans.

Risk determines rewards, or so they say. Risk is a subject that goes beyond what I am capable of fully understanding or explaining.

Just know that the financial crisis we are still experiencing has caused everyone to reevaluate how they look at risk and return. In summation, can you lose money? All-in-all, 10 percent of investors have a negative return to date. Total annualized stock return over the last years: Anyone care to guess what the returns for will be? I suspect not 15 percent. If it is, it will be coupled with heavy inflation.

Something to consider is that from to we witnessed the biggest bull market period in history. One can reasonably expect the total annualized return to decline over the next decade with respect to as a starting point. These are marketing ROIs that only take into account a portion of newer loans. The reality of the fact is, if you bought every loan ever issued on Lending Club your return would be around 5 percent annualized. Add some method to your note selection and you can get that number to double with little effort.

As I mentioned before, you only experience a stock loss when you sell. This makes it very unpleasant for someone trying to get money out of stocks when they are down significantly.

Conversely, with P2P lending this situation is not possible unless 50 percent of your notes are going into default — highly unlikely. In addition, if you stop reinvesting, within a year you will have close to 25 percent of your account balance back in cash. Of course you can always go to the secondary market and sell your notes.

This process can take a number of days — capped at seven before they expire.

If you want to sell your stock, you simply need to issue a sell order and your order will likely be filled at a price near its current value.

With P2P it will take several days. Both investments have unique liquidity issues, but you can see how selling notes may have some advantages over stocks. This is probably one of the biggest features of P2P. It does not follow the stock market at all, or at least we can not pinpoint any causal links.

It will increase a little everyday.

P2P Lending VS. Stocks - P2P Lending For The Long Run - NSR Invest

Defaults take four months to occur, which should give you some time to tweak your investment plan going forward, or even sell the note at a discount. I can reasonably state that when I look at my balance in a year, it will be greater than its present value. I cannot make the same claim for my stock portfolio. P2P gains are taxed as regular income. This is not tax efficient at all.

In order to protect your P2P gains from the tax man you will have to utilize an IRA or write a nice letter to congress begging them to allow long term capital gains on reinvested interest. From You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits. To be diverse in P2P you need to be spread out among as many notes as possible.

Work up from there if you have a larger portfolio. Diversification is one of the primary tenants of P2P investing. Notes cost nothing to buy. This is less than most mutual funds and actively managed accounts, and probably slightly higher than most ETFs.

These fees can become quite expensive for a smaller trader who wishes to actively manage. P2P lending is much more vulnerable to inflation than stocks. Companies simply raise prices with inflation. Interest rates are fixed. Luckily the longest P2P term is five years, and if you are constantly reinvesting you mitigate against inflation. I track interest rates on both platforms and they are looking good for now. If stocks are the long-term gold standard for investing, than P2P would seem to be a viable option.

All investments carry risk, so I encourage you to do your homework.

There are a number of growing resources on the Web and I hope Nickel Steamroller is your starting point. You must be logged in to post a comment. Sign up here for our newsletter!

And if you are new to marketplace lending, you'll receive a free educational series directly from our co-Founder and CEO. Skip to content Toggle navigation NSRI.

How I Made $10, on P2P Investing, and How to Make More

Invest Individual Investor Investment Advisor Learn Resources Getting Started Guide About Contact Blog Sign Up Login. Stocks — P2P Lending For The Long Run Posted on November 22, November 24, by Michael Read full article. Share on Facebook Share. Share on Twitter Tweet. Share on Google Plus Share. Share on LinkedIn Share.

Three Reasons You Should Drop Your Managed IRA and Open a P2P IRA Nickel Steamroller. May P2P Lending Update Nickel Steamroller. Leave a Reply Cancel reply You must be logged in to post a comment. Subscribe to our newsletter We'll never send you spam SUBSCRIBE. Invest Individual Investor Investment Advisor. Familiarity with p2p Investing New to p2p Some p2p experience Active. Legal Terms of Use Privacy Policy ADV.