Mutual funds that invest in dividend paying stocks

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. But not all funds are created equal; those with the highest yields often subject you to the highest risk, and some of the highest-paying funds are doling out capital gains rather than dividends.

This actively managed fund puts yield first and foremost, stating quite clearly in its strategy overview that it seeks to give its investors a "high level of current income," with a secondary objective of growing income and capital over time. It looks for companies with high yields and the capability to grow their dividends, strong dividend histories and balance sheets, and the ability to sustain earnings and free cash flow generation.

In simple language, it's a fairly standard dividend mutual fund. The Columbia Dividend Opportunity Fund is a high-yield blue-chip fund at its core. It's yielding about 3. Those who like simplicity will like what the Vanguard High Dividend Yield Index Fund has to offer.

Its managers make a list of all U. The beauty of this fund lies in its diversity and low cost, as its annual expense ratio of 0. This fund sets out with the goal of generating an above-average yield, and roughly matching the market's return with lower volatility.

It invests primarily in dividend-paying large-cap stocks, and considers the Russell Value Index its benchmark. The K class shares yield about 2. Its top 10 holdings -- all household names -- make up about It held securities at the time of this writing. A low expense ratio of 0.

Many funds pay out high yields from capital gains, rather than dividends. One of Vanguard's few actively managed mutual fundsthis one operates under the direction of Wellington Management and Vanguard's internal crew of macro analysts.

Benchmarked to the same FTSE High Dividend Yield Index as the aforementioned Vanguard High Dividend Yield Fund, it seeks to generate above-average yields from a portfolio of stocks that also offer capital appreciation potential. Over the last 15 years, it compounded its investors' capital at an annualized rate of 7. A yield that is consistently higher than the large-cap index underlies its outperformance. Low costs are a big part of what makes this fund so attractive. An annual expense ratio of 0.

This fund isn't a dividend fund by mandate, but it does frequently hold higher-yielding companies.

Dividend Funds - Dividends - Find Dividend Mutual Funds - TheStreet

The Columbia Contrarian Core Fund is managed by bargain shoppers who look for companies they believe have been unjustifiably sold off at low valuations. The fund's record is worthy of study: It posted a year average annualized return of 9.

Great Dividend Mutual Funds

Importantly, its focus on cheap stocks seemed to help it out inwhen it declined by a slightly smaller degree than the broader market. The fund's expense ratio of 0. Funds with higher turnover tend to create more taxable gains, and are probably a better fit for tax-advantaged retirement accounts.

But this one is the star of our list, generating the highest historical returns despite higher expenses and turnover. Neither the Vanguard REIT Index Fund nor the Vanguard Utilities Index Fund are true dividend funds, but they do focus on industries that pay the highest blockbuster video ticker symbol. Considering that there are few differences between sector index funds, it pays to shop the bargain bin -- and Vanguard's are some of the least expensive to own.

The Vanguard Trade emini subject futures Index Fund holds different REITs -- virtually every one of any practical size on the market today. Importantly, however, it avoids mortgage REITs, which invest in mortgages rather than forex trader academy estate, and carry more risk than traditional equity REITs.

The Vanguard Utilities Index Fund also happens to offer a beefy yield of 3. It holds shares of 80 publicly traded utilities, of which many mutual funds that invest in dividend paying stocks paid consistent and growing dividends for years. Before piling into REIT or utilities funds for high yields, be mindful of their risks.

Sector funds are undiversified by definition, and frequently diverge substantially from the broader market. You wouldn't put your whole portfolio in tech stocks, and you shouldn't stochastic intraday trading strategy all your savings in REITs or utilities in the pursuit of yield, either.

History has shown us that dividend stocks outperform. A study by the American Association of Individual Investors found that from to the end ofthe highest-yielding dividend stocks generated an average annual return of Admittedly, any historical look at dividend-paying stocks measures performance in a period of generally declining interest rates, which makes dividend stocks more attractive.

Whether dividend stocks can outperform in the rising rate environment likely to prevail ahead remains to be seen, but there are logical reasons to believe that they can. Companies that return cash to shareholders are also less likely to pursue big mergers or acquisitions, which typically turn out better for the acquiree than the acquirer. Over long periods of time, it seems likely that high-dividend mutual funds with low fees can outperform other funds while generating more income along the way.

Jordan Wathen has no position in any stocks mentioned. The Motley Fool recommends Chevron and Procter and Gamble. Try any of our Foolish newsletter services free for 30 days.

We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

The Motley Fool has a disclosure policy. Jordan is a value investor who believes incentives matter. Moats, floats, and compelling valuations. Skip to main content The Motley Fool Fool.

Premium Advice Help Fool Answers Contact Us Login. Latest Stock Picks Stocks Premium Services.

Stock Advisor Flagship service. Rule Breakers High-growth stocks. Income Investor Dividend stocks. Hidden Gems Small-cap stocks. Inside Value Undervalued stocks. Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford? Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep? Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

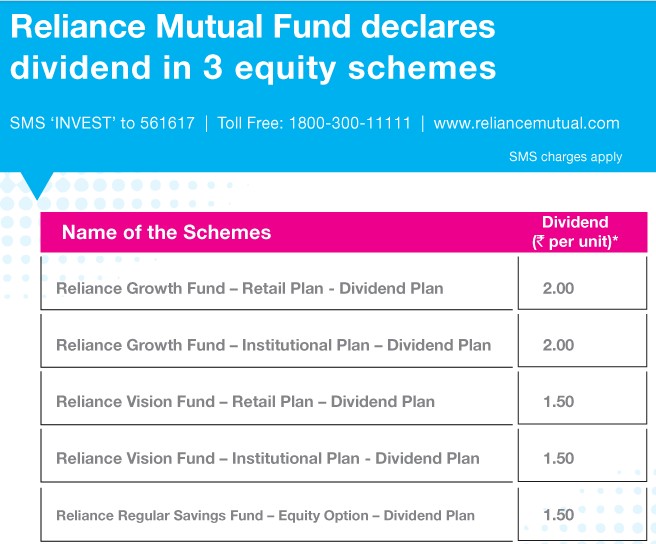

Oct 5, at 5: Dividend Mutual Fund Ticker Expense ratio Yield Columbia Dividend Opportunity Fund CDOYX 0.

Prev 1 2 3 4 Next. Motley Fool push notifications are finally here Allow push notifications to help you stay on top of Breaking investing news Earnings coverage Market movers Special offers and more Subscribe to notifications You can unsubscribe at any time.