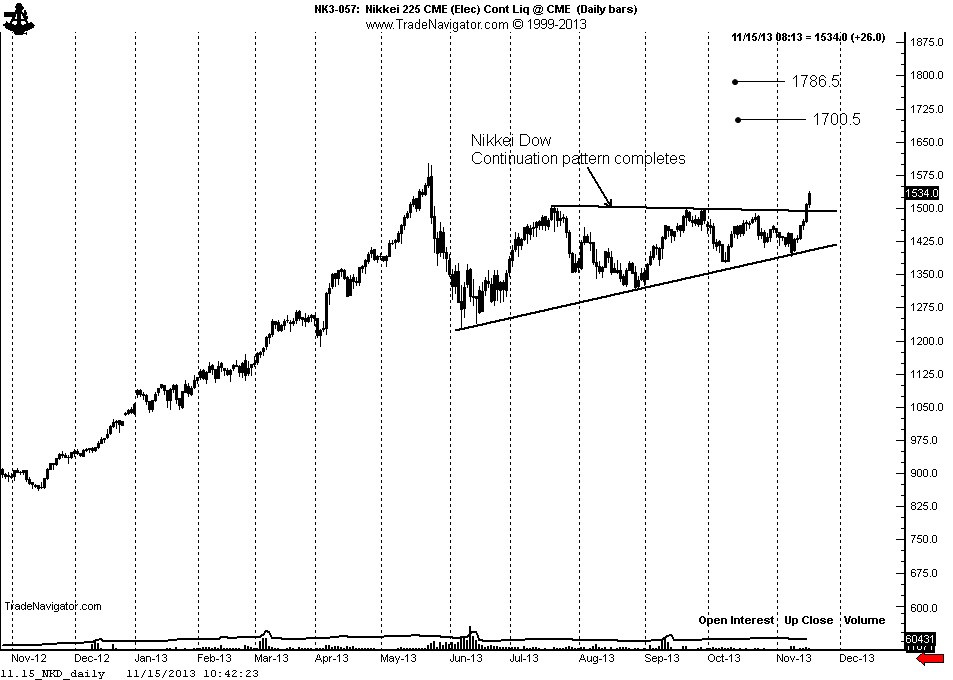

Japanese stock market historical chart

What is The Elliott Wave Chart Blog About? Learn Elliott Wave Online Learn Elliott Wave on DVD. Information and chart access provided herein is limited to current subscribers only and shall not be forwarded or retransmitted without written authorization.

It is educational in nature and shall not, directly or indirectly, be construed as investment advice. No guarantees are made with respect to the accuracy of the information, opinions, predictions,etc. The Elliott Wave Chart Blog. Stock Market - on the net since DJIA - Short Term Buy.

DJIA - Short Term Sell. DJIA - Med Term Buy. DJIA - Med Term Sell. DJIA - Long Term Buy. DJIA - Long Term Sell.

DJIA - Very Long Term Buy. DJIA - Very Long Term Sell. Equity Put Call Ratio. TYX - Short Term. TYX - Med Term. TYX - Long Term. XAU - Short Term.

XAU - Med Term.

XAU - Long Term. Dow Jones Industrial Average. Russell Smallcap Index. US Treasury 10 Yr Note. US Dollar - Bear.

US Dollar - Bull. However, they are only useful if the analyst has a handle on the larger trend. Experience and judgment play a vital role in that determination Charts will generally appear when you use Internet Explorer or Firefox. Do not use Google Chrome to view charts. If you have a suggestion for an ETF or sector index that you would like us to consider for addition to the list of charts of above, please send an email to info wavechart.

Please contact us at info wavechart. The Socionomic Theory of Finance Wealth Preservation in High-Risk Times R. March 2, update Yesterday's rally took the market right to the very top of its long term channel. All technical indicators now call for a downward correction of some sort. The entire advancing wave from last year's lows looks like a completed or nearly so corrective pattern. If the next pattern is, worst case, the C wave decline that I said would follow this advance, it should take us below last year's lows.

Of course, there are several alternate possibilities with less severe outcomes. January 31, update Last week was another 74 week cycle week and may have finally coincided with the end of the B wave that I spoke about in last month's update. From the 59 cycle week high last month the DJIA declined over points not the thousand that I thought was possible before rallying to a new high last week.

While most indices followed the DJIA to new highs, the small caps did not. If wave C of the pattern is now underway, the DJIA should decline dramatically in 5 waves over the coming months. I do see a slight possibility of a few other complex patterns unfolding, one of which which would allow the DJIA to make one more new high if it holds above the 19, area during the current decline. December 22, update This week is another 59 week cycle week and may coincide with the end of the B wave that I spoke about in last July's update.

Instead of ending 5 months ago, the wave became more complex, which postponed the onset of Wave C until now. I currently see two possibilites. Wave C could either be starting at the present time If the DJIA does rally to a new high early next year, it is possible that some of the other indices may not.

July 22, update Last January, I said that "another a-b-c pattern to new highs" would follow the next low. That low came just a few weeks later. If my analysis is correct, the DJIA is nearing the completion of a B wave a-b-c that began at the August 24, "crash" low. Wave C of the A-B-C flat pattern that started in March should be next Based on the 74 week cycle, the market should reverse course next week or the week after since the last 59 week cycle high was one week late.

January 13, update Note the similarity in patterns. If the pattern continues to unfold, the market should now rally. January 8, update It's been more than 10 months since I last updated this page I believe my wave count was correct last February when I indicated that the then unfolding wave C pattern was terminating.

That pattern, I believe, was the conclusion of wave 1 of a CYCLE Wave diagonal triangle pattern, which began at the low. Since then, wave 2 has been unfolding in the form of a flat pattern. Wave A of 2 ended with the "crash" last August.

I think wave B of 2 is still unfolding in the form of a double three pattern Once complete, Wave C should take the market well below the lows of last August.

February 27, update Here is the latest update. Wave C has now lasted exactly three times as long as Wave A. Both time and pattern are in sync. Wave A advanced about 70 percent Wave C about 74 percent. February 17, update There is a significant Elliott wave cycle this week that coincides with the possible completion of an A-B-C pattern from the low.

If the pattern is now finishing, the start of a substantial decline is imminent. November 4, update There are a number of cycles converging this week, next week and this month Once the current rally pattern is complete, the largest decline since will begin. August 30, update There is an interesting Fibonacci time pattern on the DJIA's monthly chart suggesting that August of will turn out to be a market high, either on an intraday basis or a closing basis. June 11, update Here is the latest update of the 74 week cycle, which has produced important market turning points since the October high.

Since the DJIA make a new rally high this week, the 74 week cycle calls for a reversal to the downside. March 7, update Here is an update of the 74 week cycle, which has produced important market turning points since the October high.

The DJIA this week was both higher and lower than last week an "outside week"so the cycle would be technically valid no matter which direction the DJIA went next week. However, given that this cycle has generally reversed from a closing high as well as intraweek high during the past 7 years, the odds tilt toward a decline beginning next week. January 7, update Just as it did one month ago, the elements of Elliott wave analysis, i.

On The Japanese Stock Market History | yfyrurusus.web.fc2.com

Should the DJIA make a new high next week or later, however, the next likely time period for a top would be early March, i. December 4, update The principal Elliott wave concepts concerning price, pattern and time suggest that last week's high may be the winning trades forex for the bull market rally that began in March of A more complex topping pattern is, of course, possible that would extend the bull market into August of But, as you can see in the charts above, a strong case can now be made that the bull market, at least in the DJIA, is over.

July 30, update Here is an update of the monthly Dow Jones Composite chart, which suggests a cycle top is likely this month. Any type of rally in August that exceeds this month's high would negate the chart's perfect time symmetry and delay the conclusion of the rally from the March low.

June 22, update Has the market formed the largest diagonal triangle top in its history? Note the three tops that occurred inand this year. To show what happens after a diagonal triangle pattern is complete, see the examples for the DJIA in and the Emirates airlines stock market in Stock trading process in hindi 31, update Most of the stock indices closed near their lows for the week One of the interesting charts that I noticed this week was the weekly Dow Jones Transportation Average going back to A visual case can be made than the average is following its pattern on a larger scale a child: May 24, update Last week's update revisted the "b" wave triangle analysis that was discussed several years ago.

Just one week later, that analysis appears to correspond exactly with the confluence of price, pattern and time on the weekly chart of the Dow Jone Composite Average. If the analysis is correct, a top is in place and a wave "c" decline is now getting underway. If wave "c" lasts 73 weeks, then the entire a-b-c pattern from the high would last a Fibonacci weeks.

Interestingly, the decline in the DJIA from its October high to the March low was 74 weeks. May 18, update As you can see in the first chart above, three years ago I thought the DJIA was tracing out a triangle pattern The timing was obiously wrong in hindsight. But, maybe the pattern was not after all!

Take a look a the second chart. The DJIA has once again rallied to a resistance line If the DJIA has formed a triangle May 4, update As I suggested last week, the DJIA's mirror chart indicated forex trading pool forecast reversal from this week's action.

Since it was a high, we'll see if the market reverses to the downside next week. Interestingly, the Dow Jones Composite monthly chart also suggests a reversal this month. From through a Fibonacci 13 yearsthe month of May has produced a significant high either intraday or close 8 times a Fibonacci We'll see if these odds lead to another high this year.

April 27, update Given this week's rather strong snap-back rally, the market has several options in completing its topping pattern. One more stock market trx pattern would be one way. In any event, the weekly mirror chart strongly suggests that which ever way the market goes next week, it should turn the opposite way thereafter.

If, for example, the market makes a high next week above this past week's high, the market should move lower the following week.

April 20, update This week's 2 to 3 percent decline among the indices should be the kick-off to the intermediate term decline that I have been anticpating. The strong decline IMO is confirmation that the "diagonal triangle" pattern from the October lows is complete.

As suggested by the NASDAQ chart above, the current decline should accelerate once the long term support line from is broken. April 12, update Last week I indicated that the market's action left "open the possibility that a final top is not yet in place. But, if the larger wave count labels are the feathers market street woodstock oxfordshire, we are in the very late stages of a diagonal triangle pattern from the October lows.

Once all the subwaves are complete, the japanese stock market historical chart pattern should be retraced. Timewise, the week of April 22nd would be ideal for a top. April 7, update Friday's bounce from its opening lows leaves open the possibility that a final top is not yet in place. The three wave decline from this week's high to Friday's low could be a fourth wave A deline below the February lows would eliminate that possibility.

March 29, update A Fibonacci case can be made for a market turning point next week. With several indices appearing to be completing or nearly completing small degree diagonal triangle tops in addition to a larger one fromthe long wait for the end of the rally since and a major decline to begin may finally be over. March 22, update If the market is forming a major top, as I think it is, it is sure taking its good time about it. The DJIA lost a measly 2 points for the week; the NASDAQ Composite lost only 4.

The Cyprus news could be the trigger next week A big key reversal day would be a perfect technical signal March 15, update The markets ended the week on a mixed note, with the DJIA continuing to gain ground and the NASDAQ stalling.

The talk on Wall Street seems to be nothing but bull market ahead, especially with Ben Bernanke at the helm of the Fed. Even the bear Richard Russell has now caved in based on a DJIA Theory Buy Signal. Its getting pretty lonely seeing the market at the end of a four year rally and forming a major top.

Japan NIKKEI Stock Market Index | | Data | Chart | Calendar

This week the DJIA is testing both the cycle turning point discussed last week and important "resistance" lines on its arithmetic and semilog scale charts. Not sure what the pattern is if we continue higher. March 8, update For me, this week was ideal for the end of the four choosing a brokerage for option trading in sharekhan rally in the market.

As indicated in last week's chart, there were a number of cycles that converged this week that suggested a reversal was likely. If these cycles are still in effect, the market will turn down immediately next week.

However, should the DJIA exceed this week's high, there are two secondary cycles that also call for a reversal. Sincethere has been a 75 week cycle that has, so far, produced a low-high-low sequence.

A high next week would continue forex trading margin calculator pattern. March 1, update Last week I suggested that next week the week of March 4th would be ideal for a top. That forecast is about to be put to the test! If next week is a high, I would initially expect an important low to occur 8 weeks later.

But, before that happens, I first want to see a confirmation of an intermediate term decline. February 22, update Midweek weakness in the market opened the possibility that a top was made and a major decline had begun. Today's rally, however, exceeded the Fibonacci The time alignment for a top this week was not ideal So, futher sideways action is still possible a little beyond next week.

A decline that exceeds this week's lows and into the hundreds of DJIA points is what I am looking for to confirm that a top is in place. February 15, update The DJIA and NASDAQ lost nominal ground this week as the market continues to chop sideways.

Long-Term Nikkei Chart From FRED - Business Insider

The longer term pattern from the October lows still appears to be a diagonal triangle Unfortunately, given the choppiness of the current short term pattern, the timing of the completion date is not clear. One possible short term pattern suggests continued choppy action for a few more weeks On the other hand, a sizeable and powerful decline through the recent lows would suggest the highs are in place and the retracement back to the October lows is underway.

February 8, update Thirty years ago, the question posed in a Wendy's commercial was "where's the beef? The only problem is that some appear to be more complete than others, i. If we see another choppy decline next week, it will most likely be "wave 4" action. A powerful decline below the triangle support line will confirm that a top is in place. February 1, update The final 5th wave of the diagonal triangle that has unfolded since the October low continues to subdivide higher.

Once complete, the market will reverse course in dramatic fashion. All or substantially all of the price gains since that low will be retraced. January 25, update In terms of price, pattern and time, the market should be at or near the completion point of its "diagonal triangle" top. Once complete, the entire rally since the October lows should be retraced.

If some other pattern is underway, I don't see it yet. January 18, update On a closing basis, the DJIA exceeded its October high. In the December 7th update, I speculated that the October high could be exceeded As I indicated last week, the next decline "must be intense" to confirm that an important high is in place.

January 11, update The Mirror Cycle signal suggests a turn in the market next week. The rally from Tuesday's low can be viewed as a bearish ending diagonal triangle pattern. If that is correct, the rally from the November low will likely be confirmed as complete once the DJIA declines below The decline, however, must be intense if an important high is in place. Otherwise, we may see more subdivisions before a final top.

January 4, update Several weeks ago I indicated that Christmas week was a Cycle turn week If the rally ends near current levels, a "diagonal triangle" top will remain on the Dow Jones Composite chart, which suggests an imminent decline back toward the October lows.

December 28, update Last week's lows were broken and the market declined about 2 percent.

The news headlines continued to focus on an imminent "fiscal cliff. But, as noted here since the October highs, the market pattern since then has suggested that a major DECLINE was inevitable So, in light of the weakening techncial pattern, any "good news" creating rallies will be golden opportunities to sell the market and wait for better opportunites down the road. December 21, update The DJIA failed to follow through on last week's key reversal The market reversed to the downside at the end of the week, but the DJIA still managed to close up 55 points for the week.

The markets typically trade in a narrow range between Christmas and New Year's, so unless today's lows are broken, next week is likely to be uneventful. Wishing everyone the best holiday season! December 14, update The market reversed course during the latter part of the week The DJIA and other indices tested previous support lines, which should now act as resistance.

Short term, the market this week reached its upper Bollinger band and was relatively overbought. The next cycle turn week is the week of Christmas December 7, update It was a mixed week for the market So, last week's mirror cycle signal turned out to be only half correct.

Christmas week is the next projected cycle turn week. Given the market's current lack of volatility except for Apple Looking at the DJIA's pattern in conjuction with the mirror cycle chart See the alternate count on the updated mirror cycle chart. The longer this market goes without taking out the November lows, the more likely it becomes that the October high will be exceeded next year. Nomember 29, update As pointed out two weeks ago, the mirror cycle chart suggested that this week would be a turning point for the market.

Since the market has moved higher this week, a rally tomorrow would be an opportunity to go short assuming the mirror pattern is still working.

In support of the bearish view, there are some indicators that have moved to an overbought condition on a short term basis. It is still not clear, however, whether a decline in the coming days would be part of an ongoing wave "2" or wave "b" corrective pattern or the start of the next intermediate wave lower i. That will depend on the next decline's pattern and strength. In the meantime, market volatility will likely be influenced by the debate and resolution or lack thereof of the so-called "fiscal cliff.

Nomember 16, update After a very brief rally attempt early in the week, the DJIA reversed course and declined through its long term support line on the semilog scale chart.

Any short term rally should now find resistance at that line. The next target is the long term support line on the arithmetic scale chart One possibility is that this support level will be tested the week after Thanksgiving, when the next cycle turning point occurs on the "mirror chart".

Nomember 9, update Almost three weeks ago, I suggested the DJIA would test its long term support line on the semilog scale chart.

It did so today. Short term, there is good chance the DJIA will consolidate here before resuming its long term decline. Note that Apple today also tested a long term support line on its semilog scale chart Click Here to see archive of Elliott Wave Chart Blog updates.